GENAI EMPOWERS BFSI

The 11th edition of IBEX INDIA, India’s first comprehensive trade fair and conference for the BFSI tech and fintech sectors, took place from February 21 to 23, 2024, at the Jio Convention Centre in Mumbai. Since its founding in 2011, IBEX India has maintained its goal of connecting banks and technology, with unwavering backing from the banking community, an advisory group, and endorsements from all major public and private sector banks. IBEX India is today’s definitive platform for Indian and South Asian bankers to source information, gain knowledge, and experience cutting-edge technologies and products that will deliver a seamless and secure banking experience in the digital transformation.

During the three-day Trade Fair and Conference for the BFSI Sector in India and South Asia, delegates met with leading global technology solution providers showcasing a wide range of advances. Attendees at IBEX INDIA Expo 2024 had the unique chance to remain up to speed on the latest innovations in banking automation, fintech, physical infrastructure, IT infrastructure/network, security, retail banking, Insurtech, artificial intelligence, digital banking, and more. Attendees at IBEX INDIA 2024 networked with important BFSI industry players. They were able to form important contacts with industry experts, prospective clients, and strategic partners. Attendees also acquired vital insights into current market trends, learned about industry best practices, and identified unique solutions for their own companies.

IBEX INDIA conferences included high-level keynote lectures, thought-provoking panel discussions, and special presentations. A series of panel discussions were held with an exceptional lineup of speakers, including senior executives from private and public sector institutions. The agenda for the sessions included issues such as BFSI Innovations, Trends, and Next Practices.

IBEX India was inaugurated with the unveiling of the Thought Leadership Paper titled “Gen AI and The Reshaping of The Indian Consumer Banking” by Capgemini. This insightful paper set the stage for discussions on the future of consumer banking in India. The brief presentation of the Thought Leadership Paper was done by Ms. Neha Punater, Vice President and Global Leader- BTS Practice, and Mr. Ian Campos , Executive Vice President and Global Head of FS Application Services Business at Capgemini. Their expertise brought valuable perspectives to the forefront.

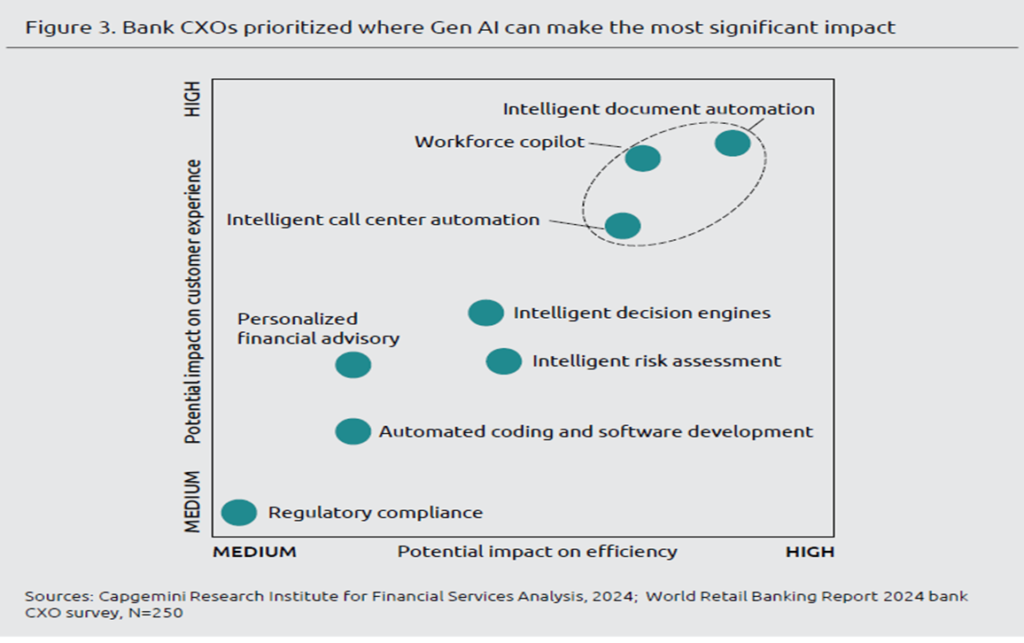

A study by Capgemini on artificial intelligence (AI) in retail banking found that only 6% of retail banks are prepared to implement AI at scale. This suggests that most banks are lagging behind in adopting AI technology.

The report warns of potential failure for banks that don’t implement AI. One reason for this is the lack of KPIs to measure success. Without clear goals and ways to track progress, it will be difficult for banks to know if their AI initiatives are effective. Employees see generative AI as a way to improve efficiency. Generative AI can be used to automate tasks, such as generating reports or creating marketing copy. This can free up employees to focus on more complex work.

Conversational AI chatbots could improve customer service by reducing call abandonment rates. Chatbots can answer simple questions and resolve common issues, which can help to reduce the number of customers who abandon calls in frustration.

Shri Vinit Goenka, Secretary of the Centre for Knowledge Sovereignty and Former Member of the Government of India’s Task Force IT, will deliver a Special Address on “Data Sovereignty in the Digital Age”. His thoughts highlighted the crucial role of data governance in today’s digital world.

The concept of data sovereignty is a continuation of state sovereignty, in which states assert control over data within their borders. This creates tensions and conflicts with the principles of globalization, particularly in the context of the digital world, and is a thought-provoking perspective on the intersection of geography, technology, and law. Sovereignty, which has long been a core principle in geopolitics, is now being applied to data in the digital age, giving rise to complex debates over who has control over the vast amounts of information that flow across national borders.

“Data Sovereignty in the Digital Age,” Shri Vinit Goenka, a data governance expert, explored the crucial concept of a nation’s control over its citizens’ data. This idea, known as data sovereignty, is paramount in the digital age where information plays a critical role in national security, economic development, and individual privacy. Goenka highlighted the challenges posed by globalization and powerful tech companies in ensuring data sovereignty. He emphasised potential policy solutions to safeguard a nation’s data and empower it to navigate the complexities of the digital world.

India seeks control over its citizens’ data (data sovereignty) to ensure national security, economic development, and privacy. This approach balances data-driven innovation with protecting sensitive information. While India enacts data localization measures, it also seeks international cooperation for fair digital trade rules. This balancing act navigates geopolitical tensions and strives for technological self-sufficiency.

Honoured to have Ms Vidya Krishnan, Deputy Managing Director (IT) of the State Bank of India, presented the inaugural address on “Thriving in An Era of Digital Innovation.” Her talk gave essential insights into managing the problems and possibilities that digital innovation presents in the banking sector.

In her keynote address, Ms. Vidya Krishnan, Deputy Managing Director (IT) of SBI, delved into the numerous challenges and opportunities that digital innovation has brought to the banking sector. She emphasized the need for banks to adapt quickly to the changing landscape and adopt digital technologies to stay competitive and relevant. Krishnan highlighted the following points:

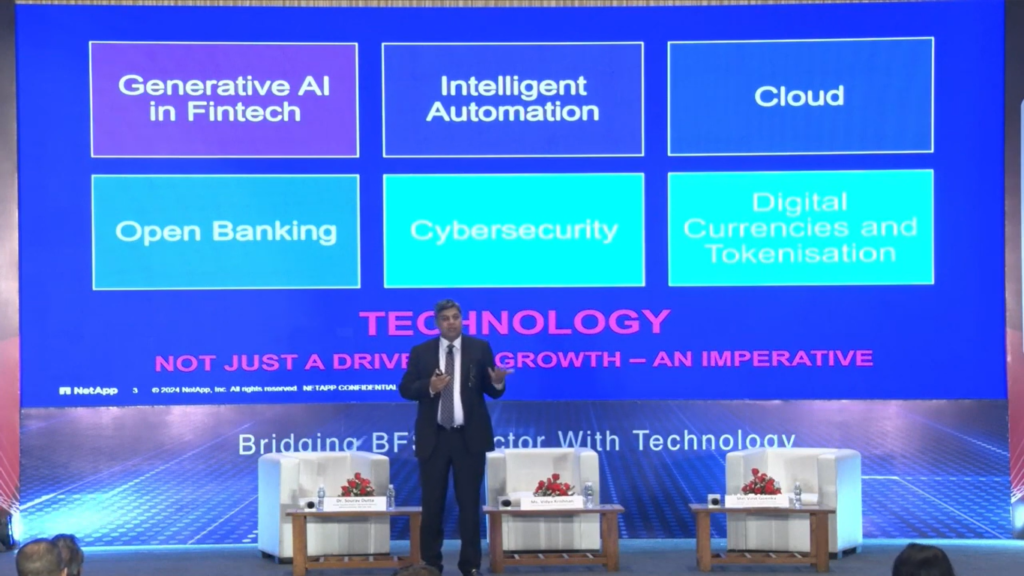

- Embracing Digital Transformation: Banks must embrace digital transformation and leverage technologies like cloud computing, big data analytics, and artificial intelligence to improve customer experience and streamline internal processes.

Continuing her address, Ms. Krishnan highlighted additional aspects of digital innovation in the banking sector:

- Cybersecurity: With the increasing digitization of banking services, the risk of cyber threats and data breaches is also on the rise. Banks must invest in robust cybersecurity measures and implement strong data protection policies to safeguard customer information.

- Fintech Collaboration: Banks should also seek to collaborate with fintech companies to harness their technological expertise and tap into new market segments, such as underbanked populations or small businesses.

Ms. Krishnan also discussed the potential of AI in the banking sector:

- AI-Powered Banking: AI can help banks to automate processes, detect fraud, and personalize customer interactions by analyzing large volumes of data in real-time.

- AI-Based Loan Approvals: Using AI algorithms, banks can make quicker and more accurate loan decisions, reducing processing times and improving the customer experience.

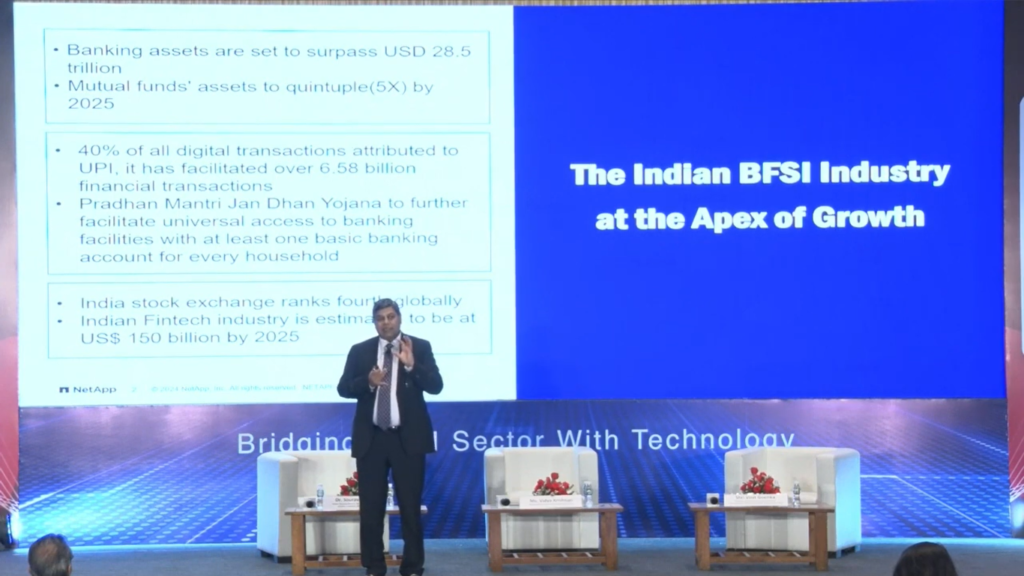

“Empowering the World with Data” Mr. Puneet Gupta, Vice President & Managing Director, NetApp India, touched on the benefits of UPI (Unified Payments Interface) for Indians:

- UPI has revolutionized digital payments in India, making transactions faster, more convenient, and more secure.

- UPI’s success is a result of collaboration between the government, banks, and technology companies, illustrating the potential for public-private partnerships to drive innovation and progress.

- UPI is a powerful example of how data and technology can be leveraged to improve the lives of millions of people, particularly those who may have been previously excluded from the formal financial system.

Puneet Gupta’s talk on “Empowering the World with Data”:

- Data is the new oil, and data-driven organizations have a significant competitive advantage.

- The rapid growth of data and the adoption of cloud technologies present both opportunities and challenges for businesses.

- NetApp’s focus is on empowering customers with data by helping them to store, manage, and protect their data, enabling them to make faster and more informed decisions.

- Data sovereignty and data privacy are becoming increasingly important issues that businesses must address.

Puneet emphasised that there are three broad areas where we see AI making a big contribution; Driving intelligence at the edge, increasing performance at the core, and accelerating analysis in the cloud.

To fully utilise AI, businesses must establish a data pipeline or fabric that connects on-premises, hosted data centres, and hyperscaler clouds, ensuring real-time visibility and management. This will allow companies to leverage all available information in real time and, ultimately, enhance commercial impact.

The 11th edition of IBEX INDIA proudly unveiled the Technology Awards 2024, underscoring the dedication to recognizing and celebrating technological prowess, innovation, and excellence within the Indian BFSI landscape. The award ceremony was evaluated by an esteemed jury panel comprising seasoned experts from the BFSI Sector , Technology, Insurance, Regulation, and Financial Services. In collaboration with IBEX INDIA 2024’s exclusive knowledge partner, Capgemini, the awards was a benchmark in recognizing excellence within the industry. The jury panel and knowledge partners had meticulously curated relevant award categories and judging parameters to ensure a fair and impartial evaluation for all nominees. Few of the winners –

Magma HDI General Insurance Company Limited for receiving an award in the Insurtech Innovation category for General Insurance at the IBEX India BFSI Technology Awards!

Union Bank of India for receiving the Excellence in Banking Innovation Award (Public Sector) at the IBEX India BFSI Technology Awards 2024!

Zuno General Insurance for winning the Innovative Product Award in General Insurance at the IBEX India BFSI Technology Awards!

IBEX INDIA 2024 studied the most recent technological breakthroughs as shown by industry specialists. The event featured firms displaying their goods, solutions, and technology skills, providing guests with a unique chance. With a three-day trade show and a two-day conference, IBEX INDIA 2024 provides an unrivalled opportunity for attendees to network and discover new prospects.