INDIANS 40 + LIFE, RETIREMENT

On January 23 and 24, 2024, India’s renowned publishing firm Outlook Group will host the first-of-its-kind retirement planning event known as the “40 After 40” Expo, with the goal of transforming retirement notions at the JIO World Centre in Mumbai. This one-of-a-kind EXPO included panel discussions, masterclasses, networking opportunities, and a range of displays highlighting retirement-related products, services, vacation ideas, hobbies, and how to plan a stress-free and financially secure retirement.

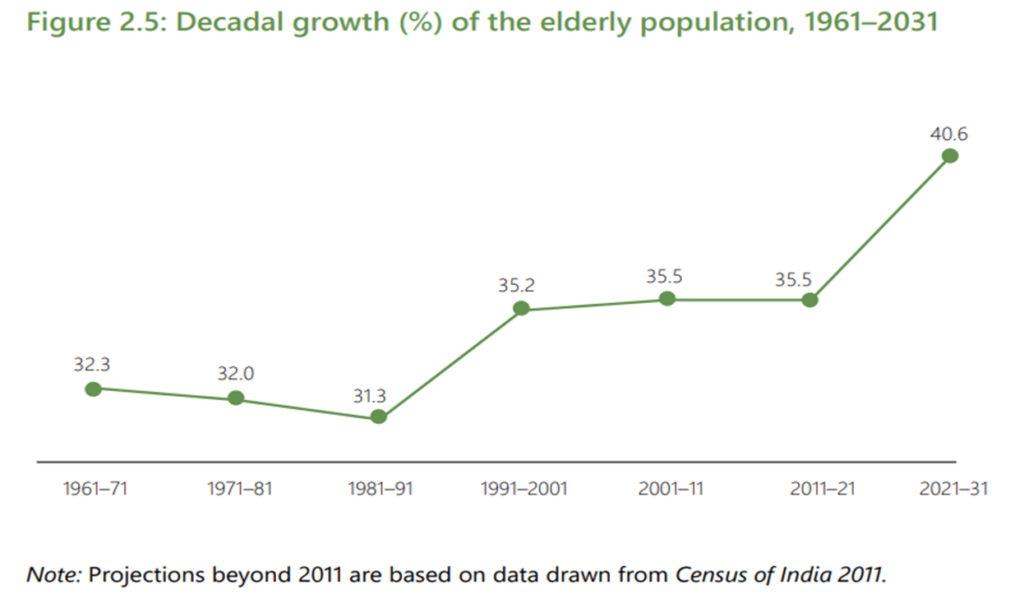

The Ministry of Health and Family Welfare predicts that India’s senior citizen population would grow from 10.38 crore in 2011 to 23 crore by 2036. This growth in the senior population needs that each individual take constructive efforts to ensure a safer and better future than the past.

As a result, retirement planning should not be put off until later, but should begin right away. After all, retirement is more than simply a financial objective or a late-in-life occurrence; it represents the beginning of a new chapter.

Outlook Money created the 40After40 Expo to help Indians traverse this exciting life stage by exploring all elements of retirement planning and providing insights and direction towards financial freedom.

The Expo redefined retirement notions, closed information gaps, and paved the way for future debates on this critical issue. The participants talked with leading industry professionals to better understand and implement ideas for a pleasant retirement life.

At the keynote address by Ananth Narayan Gopalakrishnan – Whole Time Member, SEBI, on Retirement Planning: The Role Of Right Advice,

Here are the key points takeaways :

Ananath recommended seeking professional advice for financial planning, similar to how you would consult a doctor for medical advice. Financial planning should not be seen as something for retirement only. It’s about understanding your current financial situation and planning for the future. He strongly advised against investing in anything you don’t understand and should also consider your risk tolerance before making any investment decisions. Ananth worries that influencers might mislead people with stock recommendations and hopes to achieve a balance between regulating financial advice and allowing for financial education.

The special session on Gaps In The Indian Pension Landscape by Deepak Mohanty – Chairman, Pension Fund Regulatory and Development Authority (PFRDA), emphasized the benefits of National Pension System (NPS). The speaker, Deepak Mohanty, Chairman of PFRDA, compares NPS to a balanced Indian thali meal. He observed financial literacy is low in India and people are not aware of the importance of retirement planning. People tend to underestimate the impact of inflation on their retirement corpus. He recommended NPS and APY for retirement planning. NPS is a government scheme available to everyone and APY is a small ticket scheme for low-income people.

Mohanty explained that NPS is a low-cost product that offers good returns because it is a regulated fund managed by professional fund managers. He acknowledged that there are other investment options available, but argues that NPS should be a part of a well-rounded financial plan, just like a balanced meal includes a variety of foods.

Mohanty used the analogy of an Indian thali to explain that just like someone who loves chicken wouldn’t enjoy a meal of only chicken, an investor shouldn’t rely solely on NPS. A well-balanced financial plan should include NPS alongside other investment options, such as goal-based savings for retirement, children’s education, and an emergency fund.

The Keynote Address on The Next Milestone In India’s Growth Story by Bharat Shah – Executive Director, ASK Group, according to him, building wealth is important because it liberates you from having to do things you don’t want to do just to make ends meet. When you have wealth, you can make choices based on what you love to do, not what you have to do. Bharat also said that building wealth is not just an option, it is a duty that everyone should take on. By building wealth, you are giving yourself more freedom and choices in life. Financial freedom allows you to pursue your passions and not be stuck in a job you hate, therefore, Bharat said that optimizing your wealth is not just a good idea, but a duty.

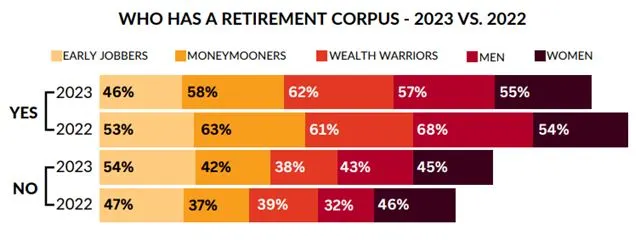

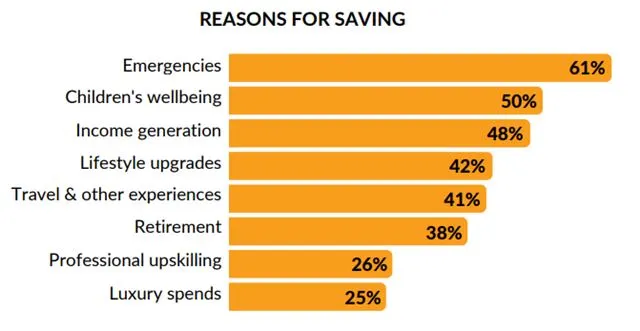

In 2023, just 57% of women are saving for retirement, compared to 68% in 2022. For men, the figure increased somewhat from 54% to 55%. Retirement planning has suffered a significant blow in India this year, with the proportion of savings for retirement falling from 45% in 2022 to 38% in 2023, according to a new annual survey report by Bankbazaar.

The special address on $5 Trillion Economy In the Making: Forecasts & Reality, Madan Sabnavis – Chief Economist, Bank of Baroda, a high GDP (Gross Domestic Product) is not the only thing that matters when considering the size of an economy. A high GDP per capita is also important.

Madan used India as an example. India is the fifth largest economy in the world today, but it has a low per capita income of around $2,400. This is much lower than Brazil’s per capita income of $7,800 and Argentina’s per capita income of $22,000. Madan argues that in order for an economy to be successful, it needs to have real GDP growth, low inflation, and increasing per capita income.

The special address on Demystifying The Life Insurance Landscape

By Anup Bagchi – MD & CEO, ICICI Prudential Life Insurance, there are three important factors for retirement planning/corpus: amount of money saved, investment time horizon, and return on investment. The speaker emphasized that these are the only three factors to consider when building a retirement corpus.

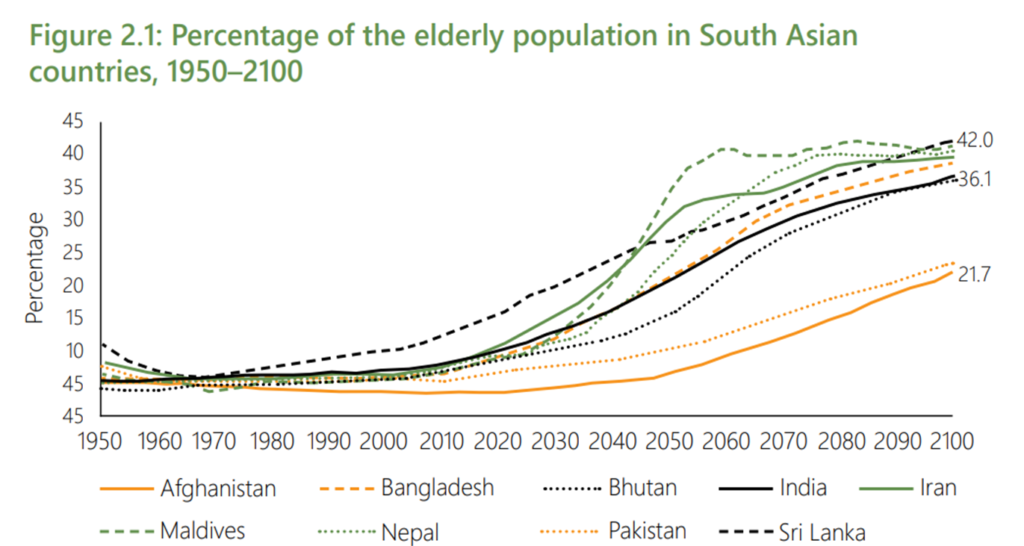

According to the India Ageing Report 2023, by 2050, seniors (those aged 60 and over) would account for 20.8% of the total population. That is close to 347 million. This is a huge rise from the 2022 demographic of 149 million senior citizens, which accounted for around 10.5% of the country’s population.

Worryingly, the poll projects that by the end of the century, India’s senior population would make up more than 36% of the total population. This projection is reinforced by the World Population Prospects 2022 report, which predicts that old people would make up 36.1% of India’s population by 2100, totaling more than 550 million people.

According to the India Ageing Report, in addition to an increase in the elderly population, there has been a drop in the number of young people. In fact, the report projects that before 2050, India’s senior population would surpass children aged 14 and younger.