GFOIS STRATEGIZES FOR GLOBAL FAMILY OFFICES

The Global Family Office Investment Summit (GFOIS) in Dubai, held at the Mandarin Oriental, on October 10th and 11th, 2024, the theme “Navigating Tomorrow’s Opportunities” presented an unique opportunity for family businesses seeking to refine their investment strategies and establish valuable connections. The summit assembled a distinguished group of ultra high-net-worth individuals (UHNWIs), family office principals, key decision-makers from government entities, and industry leaders, offering participants an unparalleled networking experience.

At GFOIS, attendees engaged with thought leaders and experts who shared insights on the latest investment trends, market dynamics, and innovative strategies tailored to the specific needs of family offices. With a particular emphasis on sustainable investing and climate-resilient projects, the summit equipped participants with the knowledge necessary to navigate the complex economic landscape and build a resilient investment portfolio for future generations.

The recent summit in Dubai emphasized the significance of investments in cutting-edge technologies such as AI, blockchain, Web3, and digital assets, as the city aims to become a global hub for tech-driven ventures. Mohamed Al Ali, the summit’s founder and Chairman of Al Ali Holdings, highlighted the UAE’s commitment to fostering innovation through initiatives like regulatory sandboxes and partnerships in fintech and digital infrastructure.

Dubai’s focus is on embracing and cultivating the potential of these disruptive technologies. These gatherings bring together industry leaders, investors, innovators, and policymakers to discuss the latest advancements and explore collaborative opportunities.

In addition to accessing the latest developments in investment strategies, participants also had the chance to explore long-term wealth management practices that aligned with their family office’s goals. By fostering sustainable practices, family businesses can establish a lasting legacy that benefits both their families and the environment.

“It is with great honor and pride that I welcome you to our Global Investment Summit here in Dubai. This event is more than a gathering of global wealth; it is a convergence of visionary minds committed to highlighting exceptional investment opportunities and pioneering ideas, with topics including Al, Web3. blockchain, digital assets, fintech, healthcare, real estate, VC, private equity, co-investing opportunities and much more. Together, we aim to build a sustainable future for generations to come, fostering growth and innovation in an ever-evolving world.” Mohamed Al Ali Summit Founder & Chairman Al Ali Holdings, UAE.

With over 300 high-net-worth individuals, family offices, private investors, and entrepreneurs who attended, the Global Family Office Investment Summit is an ideal platform for you and your project to connect with potential strategic investors. Don’t miss the next opportunity to engage with key decision-makers from government, family offices, and UHNWIs and expand your network in a rapidly evolving and dynamic market.

Meshal Alothman, Ceo & Cofounder – Capital Asset Mgmt., UAE, Marwan Jassim Al Sarkal, Founder, Al Mur Investments, UAE, Dr. Abdur Nimeri, Managing Partner & Chief Investment Officer, West Mountain Group, USA, Landon Ainge, Chief Investment Officer, Between The Coast Venture Capital Fund, USA, Naeem Aslam, Cio – Zaye Capital Markets, UK, the panelists and the Elite global investors dove into the major trends, geopolitical risks, and economic hurdles for 2024 and beyond. What are their unique perspectives and strategies for thriving in the shifting global market on topic Investor Insights for 2024 & Beyond.

The elite global investors provided valuable insights on major trends, geopolitical risks, and economic hurdles for 2024 and beyond. Here are their unique perspectives and strategies for thriving in the shifting global market:

Economic Outlook and Market Trends

Cautious Optimism Amid Uncertainty

Meshal Alothman and Marwan Jassim Al Sarkal emphasized the UAE’s resilient economic landscape. They highlighted Abu Dhabi’s focus on diversification and innovation, particularly in sectors like AgTech, to address food security challenges in arid environments. This strategy aims to position the UAE as a hub for supplying high-growth markets across the MENA region.

Naeem Aslam pointed out the ongoing renaissance in crypto, traditional finance, and sustainability. He stressed the importance of understanding global trends in Web3, digital assets, and fintech innovation to capitalize on emerging opportunities.

Investment Strategies

Diversification and Sector-Specific Approaches

Dr. Abdur Nimeri, representing West Mountain Group, advocated for a diversified investment approach, given the firm’s focus on customary management fees and performance allocations.

Landon Ainge provided insights into venture capital trends, predicting a significant shake-up in the industry. He forecasted that 15-30% of venture funds, particularly smaller ones, might face challenges or closure in 2025. This outlook suggested a shift towards more established and larger funds.

Geopolitical Risks and Economic Hurdles

Navigating Global Tensions

The investors acknowledged the complex geopolitical landscape and its impact on global markets. They discussed strategies to mitigate risks associated with trade tensions, particularly between major economies like the US and China.

Emerging OpportunitiesTechnology and Sustainability

Naeem Aslam emphasized the potential of Web3 and sustainable investments. His focus on high sustainability ventures, next-horizon projects, and investments in areas like ESG, blockchain, and digital assets indicates a strong belief in the transformative power of these sectors.

Meshal Alothman highlighted Abu Dhabi’s initiatives in supporting AgTech companies to develop cutting-edge projects for arid climates, with the goal of exporting these solutions globally.

Adapting to Market Shifts

Flexibility and Innovation

Marwan Jassim Al Sarkal stressed the importance of adaptability in the face of rapid technological changes. His experience in developing diverse projects, from vertical agriculture to urban mobility, underscores the need for investors to be open to innovative sectors.

Landon Ainge’s perspective on the venture capital landscape suggests a strategy of focusing on early-stage investments with high potential yields, while being cautious about middle-stage investments.

Long-Term Vision

Sustainable Growth and Global Impact

The investors collectively emphasized the importance of long-term thinking and sustainable growth. They advocated for investments that not only yield financial returns but also contribute to solving global challenges, such as food security, technological advancement, and economic diversification.

In conclusion, these elite global investors recommend a balanced approach that combines cautious optimism with strategic diversification. They emphasize the importance of staying attuned to technological advancements, particularly in areas like Web3, AgTech, and sustainable investments, while remaining vigilant about geopolitical risks and economic uncertainties. Their strategies focus on identifying innovative sectors, supporting early-stage ventures with high potential, and contributing to long-term, sustainable economic growth on a global scale.

Alex Lola, CEO, ATME, UAE, Nick Spanos, Bitcoin Pioneer, Chairman, Blockchain Center Miami, Founder, Bitcoin Center, USA, Vineet Budki, Managing Partner & CEO, Cypher Capital, UAE, Mariya Spartalis, Founder & CEO, Spartalis Capital, Switzerland, Adel Bhurtun, Founder & CEO, Traders Brawl Media, UAE were the panelists for the session on the Future of the Digital Asset Ecosystem, the topic being Fast forward 10 years, where are we now? as they projected the advancements and transformations in the digital asset ecosystem over the next decade.

The industry leaders mentioned shared their visions for the future of the digital asset ecosystem, projecting advancements and transformations over the next decade. Here are their key insights on where we might be in 10 years:

Mainstream Adoption and Integration

Alex Lola, CEO of ATME, emphasized the potential for digital assets to unlock fresh avenues for economic growth. He envisions a future where digital assets are more inclusive and integrated into everyday financial systems.

Nick Spanos, Bitcoin Pioneer, foresees a world where decentralized technologies have become deeply ingrained in various sectors:

– Smart cities, which he refers to as “surveillance cities,” may become more prevalent.

– Central Bank Digital Currencies (CBDCs) could paradoxically drive more people towards decentralized cryptocurrencies like Bitcoin due to privacy concerns.

Regulatory Landscape and Institutionalization

Vineet Budki, CEO of Cypher Capital, anticipates a more regulated and institutionalized crypto space:

– The speculative nature of cryptocurrencies may diminish as regulations become more established.

– Traditional financial institutions and governments will likely play a larger role in the crypto ecosystem.

Technological Advancements

Mariya Spartalis, Founder of Spartalis Capital, envisions significant technological progress:

– Blockchain technology will likely extend far beyond finance, impacting industries such as pharmaceuticals, entertainment, and technology.

– The integration of AI and blockchain could lead to more sophisticated and efficient financial systems.

Global Financial Ecosystem

The experts collectively foresee a more interconnected global financial ecosystem:

– Real-world asset tokenization is expected to become mainstream, allowing for more efficient and accessible investment opportunities.

– Decentralized finance (DeFi) platforms may challenge traditional banking systems, offering more accessible lending and borrowing options.

Investment Landscape

Adel Bhurtun, CEO of Traders Brawl Media, suggested that investment strategies will evolve:

– Singapore and Dubai may emerge as key hubs for digital asset investments and innovations.

– The line between traditional and digital asset investments could blur, with more institutional investors entering the space.

Challenges and Concerns

While the overall outlook is optimistic, the experts also highlight potential challenges:

– Nick Spanos warns of the risk of over-institutionalization, which could lead to limitations on private wallet transactions and potentially compromise the decentralized nature of cryptocurrencies.

– Privacy and data protection will likely become even more critical issues as digital assets become more prevalent in everyday life.

In conclusion, these industry leaders projected a future where digital assets and blockchain technology are deeply integrated into the global financial system and beyond. They anticipate a more regulated, institutionalized, and technologically advanced ecosystem that offers new opportunities for economic growth and financial inclusion. However, they also emphasized the importance of maintaining the core principles of decentralization and privacy that initially drove the development of cryptocurrencies.

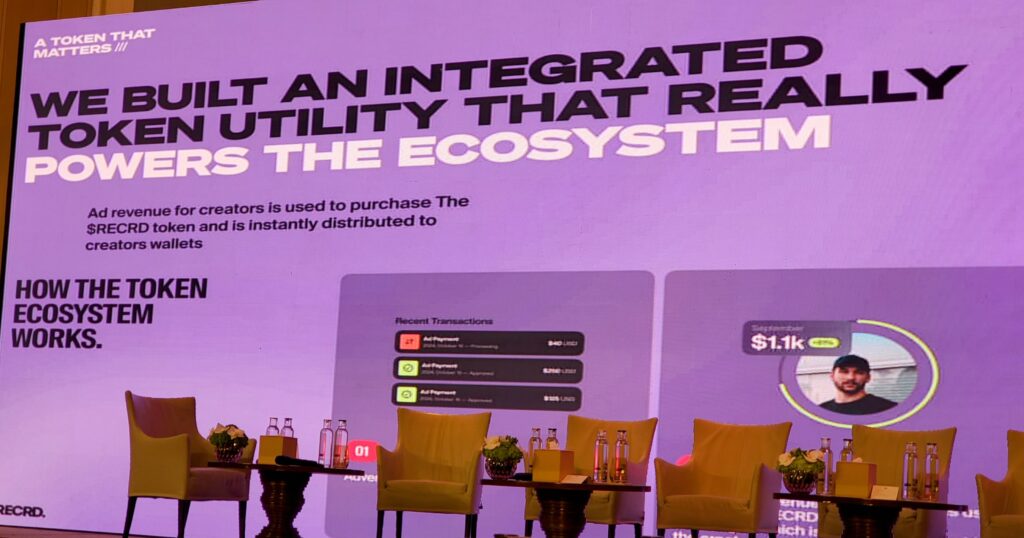

Anoir Houmou, the founder and CEO of RECRD, presented at the Global Investment Summit in Dubai in October 2024, sharing insights into his innovative Web3 video engagement platform. Here are the key points from his presentation:

RECRD’s Revolutionary Approach

Houmou introduced RECRD as a transformative SocialFi platform that is reshaping the $250 billion creator economy. The platform enables instant monetization of expressive videos by converting them into digital collectibles, creating a mutually rewarding experience for creators, users, and advertisers.

Key Features and Innovations

Monetization Model

– Every view on RECRD is monetized, with no discrimination.

– Videos are treated as tradeable assets, allowing users to buy and sell content along with associated ad revenue.

Engagement Mechanism

– RECRD introduced a unique feature called “rebounds” or “REBNDs”, which are video responses to other videos.

– This dynamic video interaction replaces traditional comments and likes, fostering more engaging and meaningful interactions.

Blockchain Integration

– The platform is built on the Sui Blockchain, ensuring transparency and creating an ecosystem where every interaction is mutually rewarded.

– All views and interactions are recorded on-chain, providing a verifiable and immutable record of engagement.

Growth and Adoption

Houmou reported impressive growth metrics for RECRD:

– Over 1.4 million daily active wallets.

– Rapid user acquisition, with the platform attracting over 500,000 users pre-launch.

Strategic Partnerships

Houmou highlighted RECRD’s strategic partnership with Shemaroo Entertainment, which aims to transform Bollywood blockbusters into digital collectibles. This collaboration opens up new avenues for fan engagement and sets a precedent for integrating entertainment with blockchain technology.

Vision for the Future

Anoir Houmou emphasized RECRD’s global vision:

– Empowering creators worldwide to monetize their content effectively.

– Revolutionizing the way people engage with content through innovative features like rebounds.

– Creating a more transparent and rewarding ecosystem for all participants in the content creation and consumption process.

Houmou’s presentation at the Global Investment Summit showcased RECRD as a pioneering platform at the intersection of blockchain, AI, and content creation, poised to disrupt traditional social media models and empower creators in the evolving digital landscape.

RECRD, a SocialFi platform backed by Sui, has partnered with Shemaroo Entertainment to revolutionize audience engagement through blockchain technology. The collaboration aims to convert Shemaroo’s extensive catalog of Bollywood movies and music into unique digital collectibles, providing fans with exclusive access to content and experiences related to their favorite films.

This partnership signifies a new wave of social engagement driven by blockchain technology, enabling innovative content monetization strategies and creating immersive experiences for audiences. By leveraging the power of blockchain, Shemaroo and RECRD are setting a precedent for the entertainment industry, demonstrating how technology can be harnessed to deepen connections between fans and their beloved content.

The transformation of Shemaroo’s catalog into digital collectibles will allow fans to engage with their favorite movies and music in a more meaningful way. As the entertainment landscape continues to evolve, collaborations like this are set to redefine how audiences interact with content, creating exciting opportunities for both creators and consumers alike.

LGFG Fashion House is a distinguished, world-renowned purveyor of bespoke clothing, catering to an elite, discerning clientele. Our illustrious roster of clients encompasses prominent C-level executives, renowned athletes, celebrated rock stars, and iconic Hollywood actors, among others. With a global presence in over 27 countries, LGFG Fashion House brings its unmatched expertise and personalized service directly to our esteemed clients, no matter their location.

Our dedicated team of highly skilled artisans and visionary designers is devoted to crafting the finest bespoke garments using premium materials and unrivaled craftsmanship. From impeccably tailored suits to refined, custom shirts and beyond, LGFG Fashion House offers an extensive selection of exquisite options to perfectly reflect each client’s unique sense of style and individual preferences.

H.H. Sheikh Yousef Al Abdullah Al-Sabah, Kuwait, H.E. Sheikh Mohammed Al Harty – Ceo – Oman Food Investment Holding Company – Oman, Shafaat Hashmi – Chairman – Stallion Gates – USA, Valery Lorenz – Founder & Ceo – Swiss Gulfstream Investment Partners – USA & Bahrain, Nikola Petkovic, Entrepreneur, Investor, Sports Agent, Kingdom of Saudi Arabia were the panelists on the dynamic investment landscape of the UAE & GCC.

The UAE and GCC economies are showing strong growth momentum, with the UAE projected to lead the region in 2025. The non-oil sector is becoming increasingly important, with GCC non-energy sectors expected to expand by around 4% in 2025. This growth is driven by ongoing diversification efforts and reforms across the region.

Industry icons above shared their proprietary thoughts on trends and strategies shaping the region’s dynamic economic investment landscape on uae and gcc. give their insights. The industry leaders you mentioned have shared valuable insights on the dynamic investment landscape of the UAE and GCC region. Here are the key trends and strategies they highlighted:

The panel featuring H.H. Sheikh Yousef Al Abdullah Al-Sabah, H.E. Sheikh Mohammed Al Harthy, Shafaat Hashmi, Valery Lorenz, and Nikola Petkovic explored the UAE and GCC’s evolving investment ecosystem, emphasizing diversification, innovation, and cross-sector collaboration. Below is a detailed breakdown of their insights:

Key Themes and Panelist Contributions

1. GCC as a Global Investment Nexus

The UAE and broader GCC are leveraging strategic geographic positioning, regulatory reforms, and sovereign wealth funds to attract FDI. H.H. Sheikh Yousef Al Abdullah Al-Sabah highlighted Kuwait’s role in enhancing regional connectivity through logistics cities and smart port infrastructure, aiming to position Kuwait as a trade hub bridging East and West. Similarly, Investopia 2025 emphasized the UAE’s leadership in renewable energy, AI, and digital infrastructure, with FDI inflows driven by policies favoring innovation.

2. Food Security and Agri-Tech in Oman

H.E. Sheikh Mohammed Al Harthy, CEO of Oman Food Investment Holding (Nitaj), discussed Oman’s push for agricultural self-sufficiency through R&D and partnerships, under Vision 2040, including water-efficient farming and food security partnerships. Initiatives like the Food Techno Park aim to optimize water resources and attract foreign expertise in agri-tech, aligning with Oman Vision 2040. He stressed that food security investments could catalyze job creation and FDI, particularly in fisheries, dairy, and sustainable farming.

3. Venture Capital and Women-Led Startups

Shafaat Hashmi, Chairman of Stallion gates Investments, highlighted the firm’s focus on pre-seed and seed-stage women-led startups in the UAE and USA. By integrating investment with marketing strategy, Stallion gates achieved a $500M+ portfolio valuation in 2023, underscoring the potential of gender-inclusive entrepreneurship. Hashmi also emphasized cross-sector opportunities in healthcare, clean energy, and e-commerce.

4. Tech Innovation and Cross-Border Partnerships

Valery Lorenz, Founder of Swiss Gulf Investment Partners, emphasized identifying high-potential startups in AI, blockchain, and Biotech. Her firm bridges Swiss precision with Gulf capital, facilitating exits like Vidpresso’s acquisition by Facebook. Lorenz noted the UAE’s regulatory flexibility and Dubai’s appeal for tech unicorns, particularly in fintech and digital currencies.

A recurring theme was the $200B+ GCC commitment to carbon neutrality by 2050. Sessions highlighted green hydrogen, circular economy models, and impact investing, with Valery Lorenz (Swiss Gulfstream Investment Partners) advocating for cross-border partnerships in clean energy

5. Infrastructure Development

Sheikh Yousef Al Abdullah Al-Sabah highlighted the importance of port infrastructure development in Kuwait, aligning with the New Kuwait 2035 strategy to transform the country into a financial and commercial hub.

Foreign Investment and Regulatory Reforms

The UAE has implemented several measures to attract foreign investment:

– Introduction of long-term residency visas for property investors

– Allowance of 100% foreign ownership in certain areas

– Improved transparency in real estate transactions through initiatives like Dubai REST (Real Estate Self Transaction)

Sustainable Development

Sustainability is becoming a key focus in the region’s development plans:- Integration of renewable energy in real estate projects- Growing interest in eco-friendly homes and wellness-focused communities

6. Sports, Tech, and Infrastructure Synergies

Nikola Petkovic, linked to data center and energy sectors, highlighted Saudi Arabia’s $3.33B data center market growth by 2030, driven by cloud adoption and smart city projects. While search results ambiguously reference sports careers, his entrepreneurial focus aligns with regional investments in digital infrastructure and AI.

Nikola addressed inflation, recession risks, and supply chain disruptions. Nikola Petkovic linked Saudi Arabia’s $3.33B data center market growth by 2030 to AI adoption and smart city projects, underscoring digital infrastructure as a hedge against volatility

Challenges, Solutions and Collaborative Strategies

– Regulatory Harmonization: GFOIS 2025 stressed the need for unified FDI policies to mitigate geopolitical risks. Panels urged GCC-wide FDI policies to mitigate fragmentation

– Talent Gaps & Development: Valery Lorenz emphasized upskilling youth in agri-tech and AI to address labor shortages. Upskilling youth in AI and agri-tech was prioritized to address labor shortages.

– Sustainability: H.E. Al Harthy advocated for circular economy models in waste management and agriculture.

Female Leadership: The summit highlighted rising female participation in family offices, with 30% of 2024 attendees being women-led entities.

Conclusion

The panel underscored the GCC’s transition from hydrocarbon dependence to a diversified, innovation-driven economy. Strategic partnerships, regulatory agility, and youth empowerment are critical to sustaining the region’s $3.8T FDI pipeline. With megaprojects like NEOM and Investopia’s global forums, the UAE and GCC are poised to redefine global investment frontiers by 2030.

The UAE and GCC region are positioning themselves as global hubs for innovation, technology, and sustainable development. The experts emphasize the importance of diversification, technological advancement, and regulatory reforms in driving economic growth and attracting international investment. As the region continues to evolve, it presents numerous opportunities across various sectors, from real estate and infrastructure to AI and financial markets.

The summit solidified Dubai’s status as a $1T family office ecosystem, with 32 first-time UAE attendees signaling growing global interest.