INDIA SUPERB MORNINGSTAR

The 13th Morningstar Investment Conference in Mumbai held on October 31, 2023 is based on cutting-edge research, insights that highlight significant findings from that research, and analysis that identifies trends and patterns to help you understand the big picture. It’s time to develop a growth mentality and keep up with the changing requirements of investors at all stages of life.

At the keynote address, Mark Mobius, a renowned emerging markets fund manager and founder of Mobius Capital Partners LLP, provided a brilliant and persuasive hyper-bullish take on India’s development potential, predicting that the benchmark Sensex might reach 1,00,000 in the next five years.

Mobius identified India as the second-largest entity in their portfolio, highlighting his optimistic view of the Indian economy and companies. “We are very positive on India…India is the second largest in our portfolio, and we have made a lot of money in the last two years. So, we are very positive on the Indian economy and companies,”

Mobius acknowledges the possibility of occasional corrections along the journey of the Sensex to 1 lakh, which he sees great possibilities, as his chances to acquire targeted quality management companies are best. “I love when markets go down because it gives an opportunity to buy cheaply.”

When markets are down, I am pleased because cheap investment options are accessible. We invest in low-debt companies. These firms may be perceived as financially secure and less dangerous. Regard to Passive vs. Active Investing – Passive investing through ETFs is excellent, but if you want to outperform the market, Active Investing is the key. As a result, it is best to diversify your portfolio with both active and passive investments. • Personally, I believe in the mid-cap/small-cap space,as Growth has great potential, which will be reflected in stock prices.

During corrections, Mobius looks for firms with a high return on capital, solid corporate governance, minimal debt, and low competitive intensity.

While certain segments of the Indian market have seen exorbitant valuations following a recent run, Mobius remains unfazed, as he recommended investors to analyse prices based on 1-, 3-, or 5-year earnings rather than just current P/E ratios.

He emphasized India’s bright economic growth prospects, emphasizing its various capabilities and the important role played by a tech-savvy youthful population. “The future of India looks very exciting,” Mobius elaborated on his investing philosophy, which prioritises the ESGC (environment, social, governance, and cultural) model when picking firms for investment, a very critical requirement.

India Story- In China, the average age is 37, however in India it stays 27. India has the potential to dominate the industrial industry; see Apple-Foxconn. Clearly displays the abundance of chances for exploration in this nation. India will become a major semiconductor producer; if you don’t believe me, consider how Indians produce diamonds. There is nothing that India cannot do. The future has yet to emerge.

In past conferences, Morningstar Investment Conference have hosted dignitaries and renowned investors such as Nandan Nilekani, Narayan Murthy, Uday Kotak, Jayant Sinha, Dr. Rajiv Kumar, Amitabh Kant, Vallabh Bhansali, Motilal Oswal, Raamdeo Agarwal, Hemendra Kothari, Sanjay Bakshi, Mohnish Pabrai, Mark Mobius, and Sri Sri Ravishankar.

Morningstar has been holding this conference for the past 12 years, making it the leading investing event in the country. In terms of design, substance, and attendance, the Morningstar Investment Conference outperforms all others.

Aside from the obvious networking opportunities, the Morningstar Investment Conference is well-known for its efforts to encourage investor success. It brings together some of the industry’s most dynamic and engaging speakers to explore current investing trends.

The Morningstar Investment Conference assists investment experts in recognizing historical lessons, understanding current events, and anticipating what lies ahead.

At the chief guest address – “India: Getting positioned for future”, BJP MP Jayant Sinha was very bullish on India’s outlook, at the Morningstar Investment Conference in Mumbai, sounding out the key major themes of India, Green energy, digitization and de-risking global supply chains.

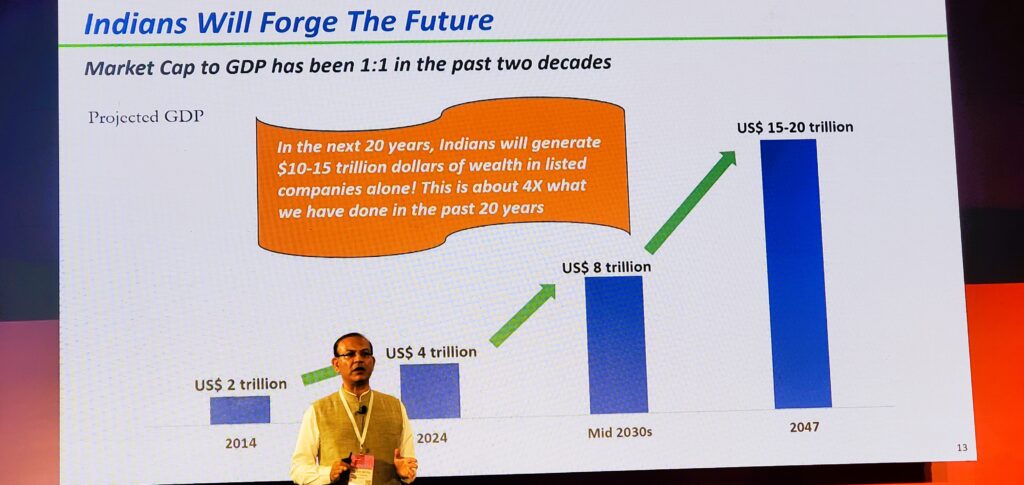

According to Jayant Sinha, India currently at $4 trillion in GDP and expanding at 6-7 percent each year, which implies GDP will double every ten years or so. By the time 2047 rolls around, our GDP will be about $15-20 trillion. It is simply the law of large numbers. India’s market capitalization-to-GDP ratio has been 1:1, and over the next two decades, Indians will earn $10-15 trillion in wealth from listed firms alone. “This additional wealth creation is about four times of what we have done in the past 20 years,” Sinha added.

“What is the Fed going to do? What’s going to happen to oil prices? What policies is the government going to introduce in the budget, that’s the noise that surrounds our day. Investors need to look beyond these,” said Sinha at the conference.

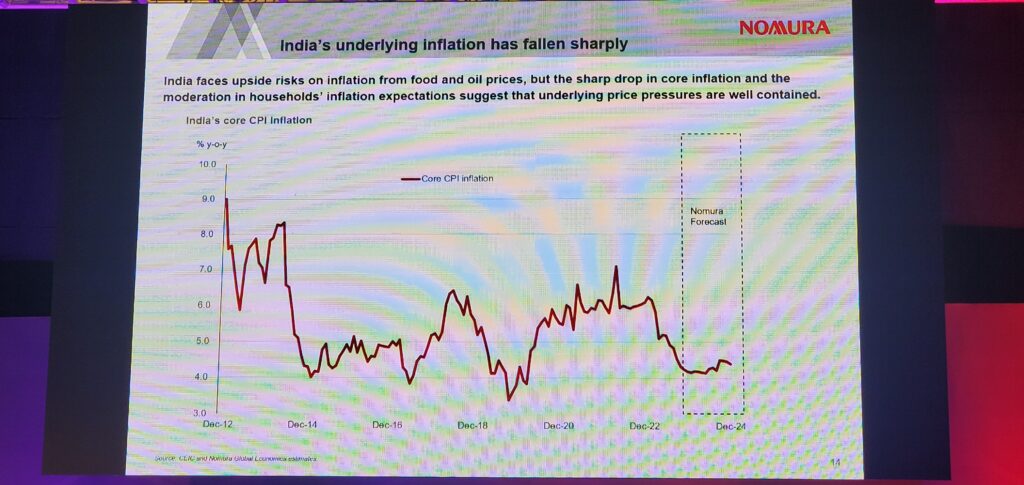

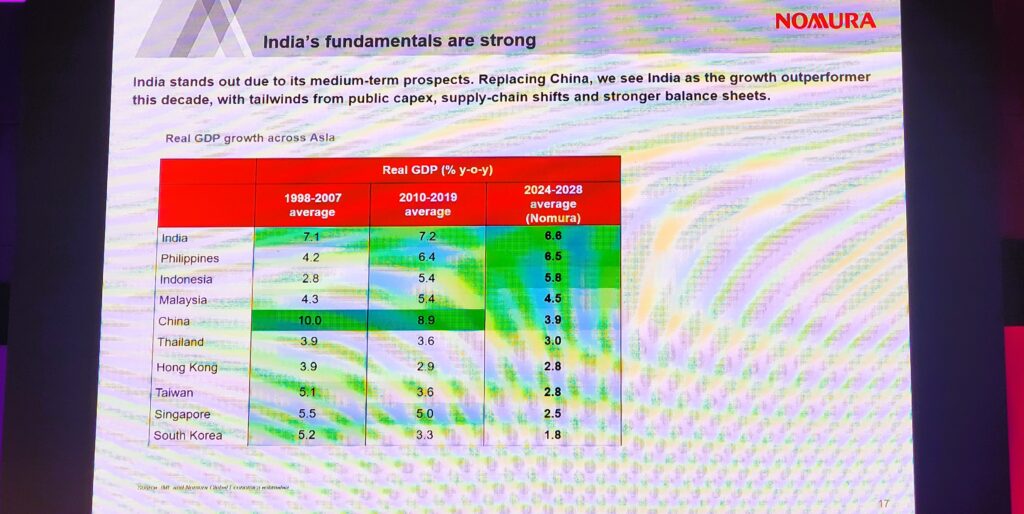

Sonal Varma delivered the presentation on ‘The Global Cocktail: Inflation, Interest Rates, Recession.’ India looks to be in a good situation right now, as India’s policy certainly stands out as a bright spot in the global economy, with GDP holding up, inflation falling, and policy easing on the horizon. However, hazards persist.

First, given China’s cyclical and structural issues, a true recovery is not yet certain. Second, we view poor global demand as a danger, with the Eurozone and the United Kingdom both likely in recession, and the United States likely to enter a mild recession in the third quarter of 2024. Third, threats to last-mile inflation persist owing to persistent wage inflation, geopolitical uncertainties, and climate change. Food prices being influenced by El Nino. These conditions are likely to last till early 2024.

The value vs. growth debate rages on, but the lines are getting blurred. The development of new-age firms with asset-light strategies, the scale and speed of technological disruption, greater market volatility, and the political and cultural implications of globalisation are all influencing value measurements. Businesses recognise the necessity for transformation in order to remain relevant. A broad classification of the two investment approaches today appears improper and sloppy. At the panel discussion: Growth vs. Value: Requiem or Reinvention?, Siddharth Bhaiya of Aequitas Investment, Rushabh Sheth of Karma Capital Advisors and Vikas Khemani of Carnelian Asset Advisors, discussed the art, science, and practice of valuing stocks. They gave insights into how their investment approaches have developed, as well as the fundamental concepts that guide their judgements.

Vikas Khemani said, The first instance of multifaceted expansion, something not seen in the previous 25 years. Banking, manufacturing, infrastructure, real estate, startups, and so on are all examples of sectors that have transformed. Today, we are certainly spoilt with options. Fundamental tax changes, like as GST, have been critical cornerstones of our exponential growth. Cash economy with inefficiencies are a thing of the past. The next ten years will bring extraordinary growth.

Siddhartha Bhaiya on high PE Stocks valuations justified. Distinguish between growth companies and what the market refers to as growth stocks. Growth is about the future, which is unknown. The only way to capture growth is to comprehend cycles, and cycles continue longer than we realise. Infrastructure These are the same stocks that were quoted at bankruptcy prices three to four years ago and are now worth 20 times more. The key is to discover highly good firms at bankruptcy valuations; sometimes it works, sometimes not. If not, the Margin of Safety comes into play.

• Value Trap – If a stock performs well, it is a value stock; if it does not, it is considered a value trap. There are far more growth traps than value traps. When you purchase value with a margin of safety, you offer yourself a very good chance.

Rushabh Sheth on Innovation is essential. Keep developing, or someone will take your slice of the pie. A forward-thinking approach may certainly help you retain a competitive advantage. My son can spend a day without toothpaste, but if you ask him to go two hours without connectivity, he won’t last. Technology has been the driving force, and those who adapt have benefitted.

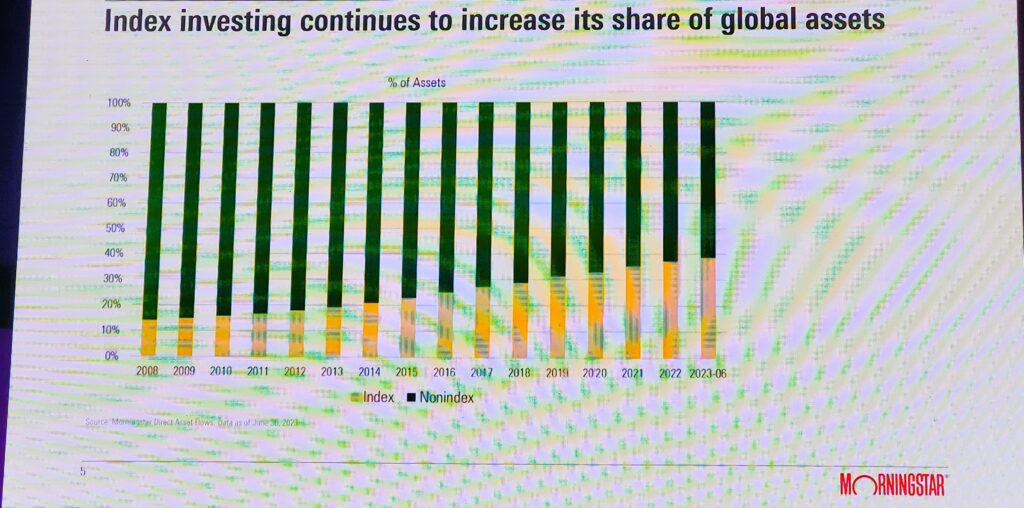

Role of Indexing in Portfolios by Rolf Agather shared some insight on the use of Index strategies to achieve financial goals. The index will be used as the foundation for an investing plan. It is critical to recognise that the index plays a vital role throughout the investment management process, whether as a benchmark, the foundation of an investment strategy, or the final analysis of portfolios.

“Index investing continues to increase its share of global assets and a more thoughtful approach. 39% of total fund assets are being managed against an index.” Rolf Agather, Morningstar

Despite India’s good macroeconomic outlook, senior fund manager Prashant Jain of Dalal Street cautions that if US bond rates increase beyond 5.5-6%, the domestic stock market may collapse further. “The only concern is the trajectory of US yields. While the recent increase from 1% to 5% hasn’t yet significantly impacted India, a further rise, especially beyond 5.5-6%, could influence Indian yields. This might result in additional Foreign Institutional Investor (FII) selling, potentially causing corrections in the markets,” Jain said last evening at the Morningstar Investment Conference in Mumbai.