DUBAI DRIVES GLOBAL SUSTAINABILITY

Dubai is readying itself to become the focal point for action against climate change as the Dubai International Financial Centre (DIFC), the global financial hub in the Middle East, Africa and South Asia (MEASA) region, prepares for the first ‘Future Sustainability Forum’, which will be held 4 to 5 October 2023, managed by TRESCON.

To learn more about this event and to secure your registration, please visit: www.futuresustainabilityforum.com.

#DIFC continues to drive action for global climate change with over 1000 global industry leaders to convene in Dubai at the upcoming Future Sustainability Forum.

Dubai International Financial Centre (DIFC) will host the inaugural edition of the Future Sustainability Forum ahead of COP28, will connect industry leaders, investors, tech disruptors and policymakers. The two-day global event, the Future Sustainability Forum will have 1000+ C-suite leaders and 100+ sponsors, more than 50 speakers representing over 30 countries on 4-5 October 2023, and partners come together to leverage a global platform for sustainable #Finance and #Tech.

The Forum’s purpose is to bring together global decision and change makers to explore ways to lead action on climate change, deliver a just transition to a sustainable economy and accelerate efforts to achieve the longer-term goals of the #Paris Agreement and UN SDGs 2030.

DIFC is actively advancing its commitment to global climate initiatives by forging strategic partnerships with influential institutions like the Global Ethical Finance Initiative. This initiative is transforming the global financial industry by focusing on key areas such as achieving Net Zero emissions, promoting Islamic finance, and financing sustainable development projects.

The inaugural forum aligns with DIFC’s commitment to play a leading role in advancing COP28 priorities and its chairmanship of the Dubai Sustainable Finance Working Group, which was established in 2019.

Arif Amiri, CEO of DIFC Authority, said: “We are thrilled to welcome the world to Dubai and the Future Sustainability Forum as part of our ‘Path to COP28’ programme. As the nation prepares to host COP28, the forum underscores our commitment to addressing pressing environmental challenges. Through collaboration and innovative financial solutions, we aim to drive tangible progress towards a low-carbon, climate-resilient future.

“We are committed to contributing to the United Nations Sustainable Development Goals and look forward to enabling meaningful dialogue and actionable outcomes at this important event and beyond.”

The Future Sustainability Forum also aligns with DIFC’s 2030 Strategy to drive the future of finance, and on Dubai’s position as a global leader for green and sustainable bonds and sukuks.

Its agenda supports COP28’s four-pillar plan on fast-tracking the transition, fixing climate finance, focusing on adaptation to protect lives and livelihoods, and making COP28 fully inclusive, announced by Dr Sultan Al Jaber, COP28 President-Designate and Minister of Industry and Advanced Technology.

The UAE and Dubai governments have spearheaded a range of comprehensive sustainability programmes in the pursuit of a net zero future. With initiatives such as the Dubai Clean Energy Strategy 2050, the UAE Net Zero 2050 strategic initiative and the UAE Vision 2070, which underscore the focus on renewable energy adoption, water conservation, waste management and sustainable urban development.

These strategic initiatives reflect the nation’s proactive approach to addressing environmental challenges for a sustainable future.

The DIFC Future Sustainability Forum is a platform for global leaders and innovators to share their visions and action towards increasing the availability and accessibility of Climate finance to accelerate climate action and achieve the long term goals of the Paris Agreement. It will support the DIFC community in embedding ESG and enabling the transformation needed to achieve net-zero emissions by 2050. It is set to galvanise key stakeholders, including the finance and insurance sectors, towards accelerating net-zero goals, the forum offers a platform to explore future sustainability and climate technologies critical for the world’s net-zero agenda and achieve the United Nations Sustainable Development Goals while contributing to the delivering the objectives of the Paris Agreement.

The two-day DIFC sustainability forum will explore how the financial sector can lead the charge in addressing climate change, promoting a just transition to a sustainable economy, and aligning efforts with the long-term goals of the Paris Agreement and the United Nations Sustainable Development Goals for 2030. The forum will discuss issues such as the current global and regional Start-up landscape while looking at how corporates drive ESG Innovation among many others. Join us by getting involved in ushering a new sustainable future for the region by listening to captivating discussions, latest technology use-cases and meet innovators who are changing the game in sustainability.

The forum will discuss issues such as the current global and regional Start-up landscape while looking at how corporates drive ESG Innovation among many others.

DIFC explained that, globally, an estimated USD $3.3trillion to $4.5trillion is required annually to achieve the 2030 Agenda for Sustainable Development.

Mohammad AlBlooshi, chief executive officer of DIFC Innovation Hub, also commented as the forum draws closer: “The Forum will focus on mobilising sustainable finance and innovation by connecting industry leaders, investors, tech disruptors, and policymakers, and help channel investment flows between the global north and global south, to accelerate climate action.

“Our mission is clear: We want to pioneer change, foster collaboration, and ensure that the finance sector stands at the forefront of sustainable practices.”

Strong demand from expectations has driven the growth of the sustainable debt market. However, expectations are rising for governments and organizations to deliver on their sustainability commitments.

Driving climate action

The Forum’s Agenda will support COP28’s 4-pillar plan on fast-tracking the transition, fixing climate finance, focusing on adaptation to protect lives and livelihoods, as well as making COP28 fully inclusive.

The Future Sustainability Forum will also look to spotlight the UAE’s sustainable practices, particularly within the financial ecosystem, inviting global experts to connect, collaborate and share insight to accelerate the global transition towards a low-carbon, climate-resilient future.

Panel discussions and sessions include:

- ‘Supporting corporates in embedding ESG within their organisations’

- ‘Empowering companies to design their path to Net-Zero’

- ‘Unlocking the potential of ESG-driven innovation’

- ‘Fostering sustainable entrepreneurial ecosystems’

- ‘Transforming capital to drive the low carbon transition’

As the event prepares to discuss the importance of environmental conservation and private investment, the stellar lineup of speakers at the upcoming Future Sustainability Forum include:

Ghiwa Nakat, executive of Greenpeace MENA; Laila Abdullatif, director general of Emirates nature at WWF; Satya Tripathi, secretary-general of the Global Alliance for a Sustainable Planet; Matt Brown, chief sustainability officer at Expo City Dubai; as well as Shivam Kishore, senior advisor at the United Nations Environment Programme.

John Revess, Senior Director of Net Zero Transformation at the World Business Council for Sustainable Development, once said, “In this decade of action, it’s really imperative that every company deals with its impact on climate change, biodiversity loss, and mounting inequality.”

Over the past few years, there has been a growing concern regarding the adverse impact of the rising temperatures of the planet. The increased demand for diversifying the economy has put governments around the world in action by fostering an environment of growing collaborations between enterprises, corporations and government agencies.

The need for greater transparency has driven the focus towards the adoption of environmental, social, and corporate governance (ESG) policies. The Middle East and North Africa (MENA) region has been taking significant strides towards diversifying their economies from an oil driven economy to a more environmentally sustainable economy.

The World Business Council for Sustainable Development (WBCSD) is a global, CEO-led organization of over 200 leading businesses working together to accelerate the transition to a sustainable world. With the contribution of non-business partners, WBCSD helps make its member companies more successful and sustainable by focusing on the maximum positive impact for shareholders, the environment and societies.

As per a recent study by PwC, there has been a tectonic shift in the attitudes of corporates in the MENA region, wherein they play an active role in demanding a changed mind-set with respect to climate change and seek a stronger climate reform.

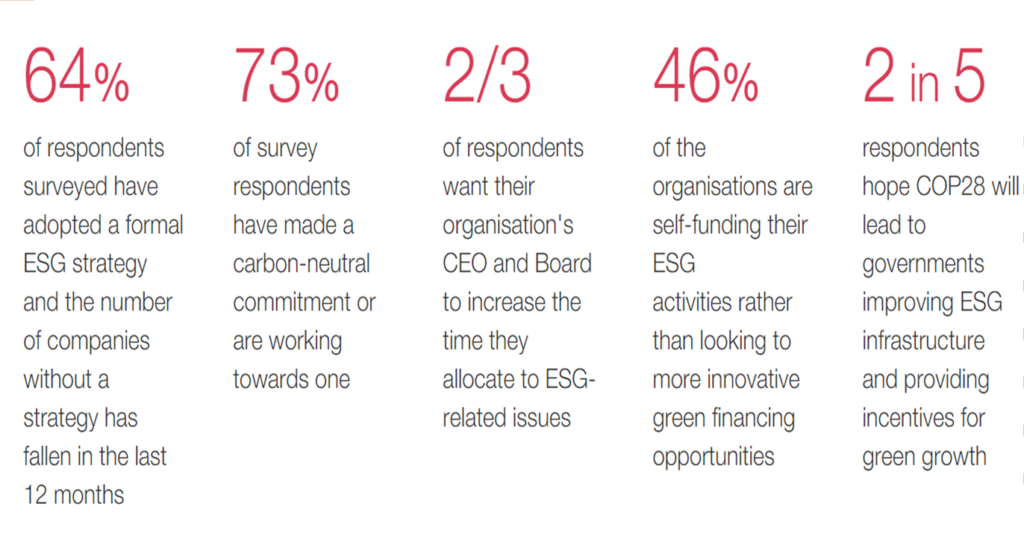

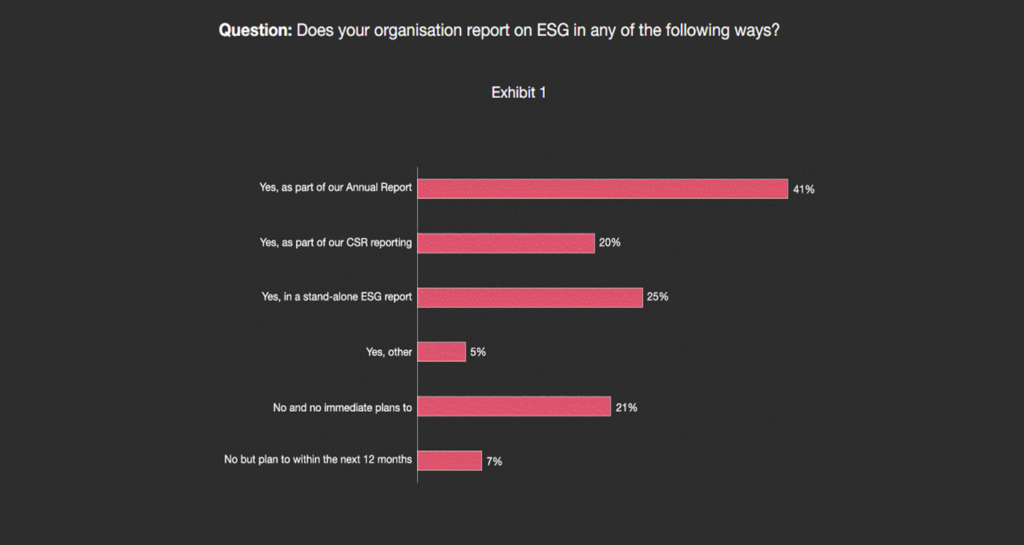

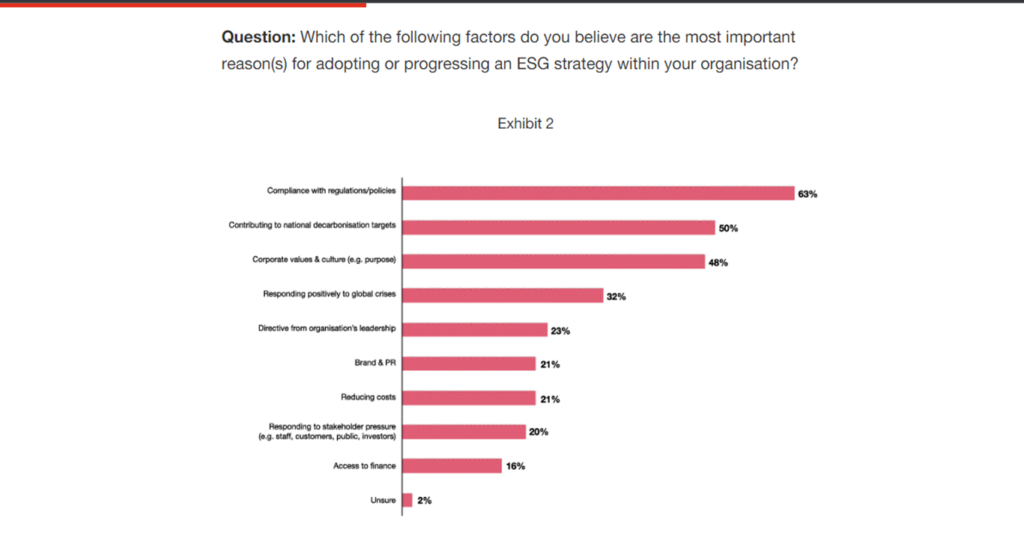

Companies in the region understand that the changing times demand greater accountability and transparency. This is the reason why there is an increase in the public reporting about their operations and how much impact it has on the environment. As per the report, 64% of the respondents to their surveys have acknowledged the adoption of a formal ESG strategy and embedded their ESG priorities over the past year.

Yet, there is a need for unlocking green financing and sustainability skills to help the region realise their climate goals. The same report states that there is burgeoning gap in sustainable financing, only 13% of business in the region are accessing sustainable financing and challenges still remain due to the green skills gap.

The key findings in our second year of conducting this research in the region, of the PwC 2023 report on environmental, social, and governance (ESG) issues in the Middle East zone in on the “E” pillar, related to the environment. They highlight the continuing progress that companies are making to ensure their strategy, operations and processes are more sustainable, even as they indicate the road still to travel.

The UAE is set to host COP28 later this year – this seems fitting as UAE announced 2023 as the ‘year of sustainability’. With a 32% year-on-year growth in green and sustainable finance issuing for 2022, UAE is growing to be one of the many cases of the increasing ESG momentum in the region.

Government initiatives such as UAE’s Net Zero 2050 and UAE Energy 2050 are some of the many initiatives taken by the government to smoothen the path towards a sustainable and resilient economy.

With this mission in mind, DIFC is hosting the Future Sustainability Forum at the Ritz Carlton in Dubai on 4-5 October 2023. This outcome-driven forum brings together global industry leaders and innovators, providing them with unique perspectives while setting the standard for action-oriented sustainability dialogues.

The Dubai International Financial Centre (DIFC), a globally renowned financial hub, is thrilled to announce Commercial Bank of Dubai as the co-host for the inaugural Future Sustainability Forum. This collaboration will further invigorate the regional innovation ecosystem, propelling industrial sectors towards adopting ESG measures and steering the region towards a low-carbon and climate-resilient future. The collaboration further establishes a longstanding partnership between CBD and DIFC to promote innovation in the region.

The forum co-hosted by the Commercial Bank of Dubai will invite eminent leaders from the public and private sectors to engage in ground-breaking discussions on sustainability’s impact on the global financial market.

Commenting on the partnership with DIFC, Dr. Bernd van Linder, Chief Executive Officer of Commercial Bank of Dubai said: “Commercial Bank of Dubai is proud to co-host the Future Sustainability Forum, a platform that aligns perfectly with our commitment to sustainability and responsible finance.

As a longstanding financial institution in the UAE, we recognize the importance of driving the transition towards a greener future. Our sustainable financing framework and the successful issuance of our inaugural green bond demonstrate our dedication to supporting the UAE’s journey towards a climate-neutral economy.

Through collaboration with the Dubai International Financial Centre, we aim to highlight the future of sustainable finance, furthering our collective mission to promote sustainable and responsible financial practices in the region.”

With the pivotal COP28 Summit on the horizon, the forum will underscore the shared commitment and efforts aimed at showcasing UAE’s unwavering dedication to advancing the United Nations Sustainable Development Goals.

We have handpicked a select group of sustainability pioneers from CBD, Deloitte, and Middlesex University Dubai, to bring their knowledge and expertise together to develop innovative solutions that tackle sustainability challenges.

By nurturing a sustainable and innovative ecosystem, the Future Sustainability Forum encourages collective action against climate change and mobilizes towards this critical cause.

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 72 countries with an approximate population of 3 billion and an estimated GDP of USD 8 trillion.

With a close to 20-year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast-growing markets with the economies of Asia, Europe and the Americas through Dubai.

DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of over 36,000 professionals working across over 4,300 active registered companies – making up the largest and most diverse pool of industry talent in the region.

The Centre’s vision is to drive the future of finance through cutting-edge technology, innovation, and partnerships. Today, it is the global future of finance and innovation hub offering one of the region’s most comprehensive FinTech and venture capital environments, including cost-effective licensing solutions, fit-for-purpose regulation, innovative accelerator programes, and funding for growth-stage start-ups.

Trescon is the world’s fastest-growing business-to-business events, training, marketing and consulting company primarily focused on the adoption of sustainability, inclusive leadership and emerging technologies like artificial intelligence, blockchain, metaverse, cloud, fintech, data analytics and cyber security.

Our summits, conferences, and expos create real economic impact by connecting and empowering the key ecosystem of government organizations, regulators, policymakers, private sector companies, solution providers, startups, investors, accelerators, advisors, consultants, associations, academia and more.

Thought leadership, knowledge exchange, brand positioning, business expansion, market penetration, lead generation, finding solutions & services, capital raising, capacity building, training and networking are among the key objectives of our stakeholders.

With the help of our 250+ employees across offices in 6 countries, several of our clients have quadrupled their leads, shortened sales cycles by half or less, entered markets three times faster, closed deals within unimaginable timelines and grown their businesses ultimately.

Whether you are an organization or an individual, Trescon has something to offer you.

WBS has hosted over 20 editions in over 10 countries and has worked with an expansive list of government, private sector companies, and associations from around the world. These entities share our vision to help foster the continued growth and development of the web 3.0 ecosystem.

Trescon produces 100+ events annually across 10+ countries in partnership with major organizations and government institutions worldwide. The organization is now synonymous with several global flagship events, including World AI Show, World Blockchain Summit, World Cloud Show, and World FinTech Show.