DYNAMIC GEOPOLITICAL ENVIRONMENT

GTR India 2024, organized by Global Trade Review (GTR), took place in Mumbai on 22 May 24, providing a unique platform for trade experts, policymakers, and business leaders to discuss and analyze the key factors shaping India’s trade landscape. The event attracted over 600 delegates, reflecting the strong interest in India’s growing importance in global trade.

This year’s conference focused on navigating the challenges and opportunities emerging from the rapidly changing business environment and geopolitical landscape. With a lineup of more than 45 expert speakers, attendees gained invaluable insights into the evolving dynamics of trade, supply chain management, export financing, and infrastructure development in India and its key trade partners.

GTR India 2024 also provided attendees with an excellent networking opportunity, enabling them to connect with industry leaders, peers, and potential clients in the exhibition hall. By fostering collaboration and dialogue among key stakeholders, the event underscored the significance of India’s role in the global trade ecosystem and its potential to drive growth and innovation in the region.

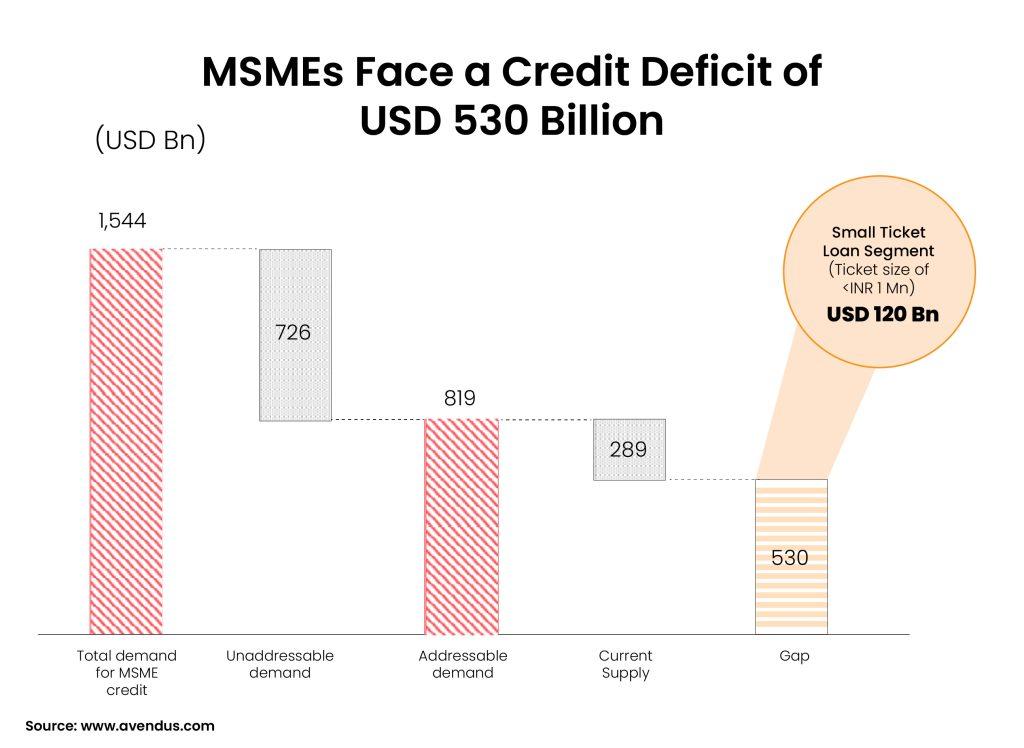

Sanjay Desai, Vice-President & General Manager (Asia) at Supply Technologies, opened GTR India 2024 in Mumbai by positioning India as a resilient “safe harbor” in global trade, citing its 6–7% GDP growth amid global economic challenges and advocating for accelerated progress toward its $5 trillion economy goal. He emphasized the critical role of digitization, referencing India’s Unified Payments Interface (UPI) and blockchain initiatives like GIFT City to modernize trade finance while urging interoperability with global systems to reduce reliance on paper-based processes. Desai highlighted the need to bridge the $240 billion financing gap for MSMEs, which contribute 40% of exports, by adopting AI-driven credit tools and blockchain-enabled supply chain finance models to support deep-tier suppliers.

Regulatory harmonization, particularly through GIFT City’s IFSCA guidelines, was framed as vital for advancing tokenized commodities and aligning with global standards like the ICC’s Digital Trade Standards Initiative. On sustainability, he stressed ESG compliance as non-negotiable for accessing Western markets, urging extension of decarbonization efforts to Tier-2/3 suppliers and advocating for circular economy innovations like bio-manufacturing and agro-waste valorization.

Desai cited Reliance Industries’ renewable energy integration as a benchmark while calling for blended finance mechanisms to scale green initiatives, such as pay-as-you-recycle models for e-waste. He criticized fragmented data systems hindering ESG transparency and proposed mandatory BRSR disclosures and green bonds for SME decarbonization projects.

The speech underscored the importance of adopting the Model Law on Electronic Transferable Records (MLETR) to legalize digital trade documents, reducing delays in cross-border transactions. Desai concluded by advocating for a public-private task force to address data silos and skill-building programs in blockchain and carbon accounting to drive systemic reforms. His remarks set a collaborative, action-oriented agenda for the conference, linking India’s trade ambitions to pragmatic digitization, regulatory coherence, and sustainability imperatives.

Dr. Rumki Majumdar, Chief Economist at Deloitte India, outlined India’s strategic priorities for trade resilience at GTR India 2024, emphasizing export diversification to mitigate geopolitical risks, citing partnerships with emerging economies like BRICS as critical amid rising global trade restrictions. She highlighted India’s logistics cost reduction to 8.9% of GDP and stressed the need to reach 7% by 2030 through port modernization and digitized documentation to achieve its $2 trillion export target. The shift toward “friend-shoring” by Western nations presents opportunities in sectors like semiconductors and clean energy, though retaliatory trade barriers threaten competition, requiring alignment of PLI schemes and GIFT City’s regulatory sandbox with global investment trends.

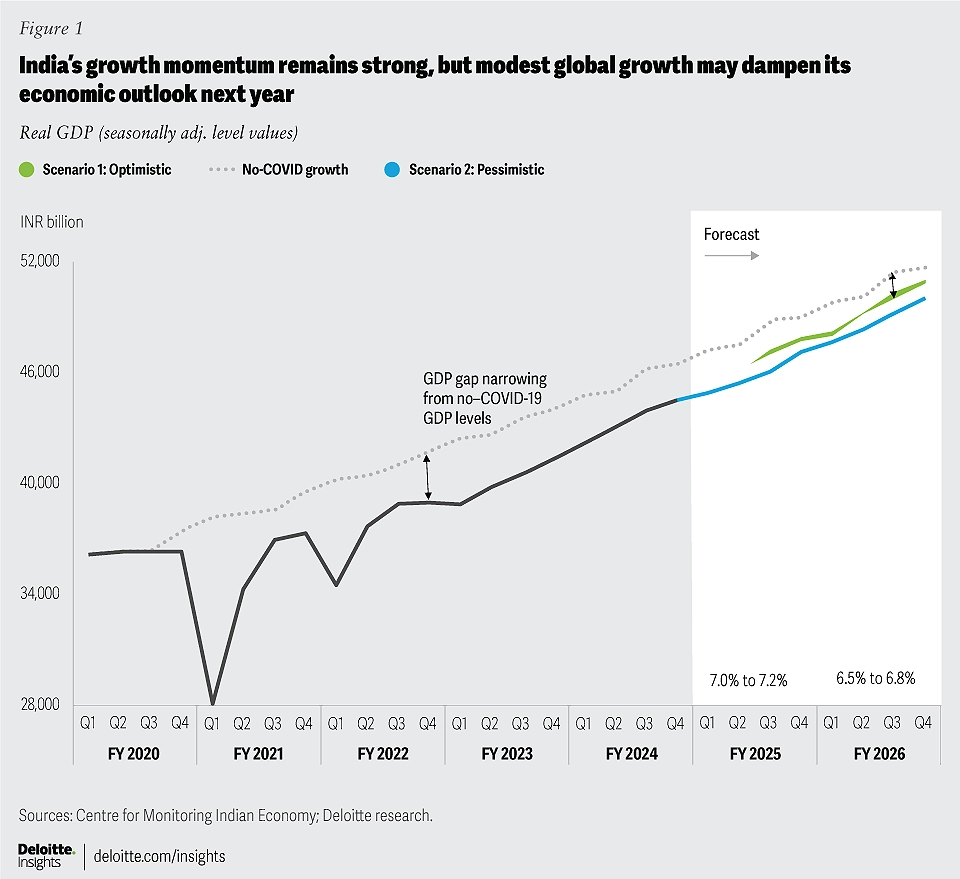

India’s macroeconomic resilience—6.4% GDP growth, stable agriculture, and robust services exports—buffers against volatility, while blockchain adoption in trade finance (e.g., NeSL, GIFT City) and MLETR implementation could eliminate paper-based inefficiencies. ESG compliance was framed as non-negotiable for market access, urging extension of decarbonization efforts to Tier-2/3 suppliers, leveraging Reliance Industries’ models and blended finance for circular economy projects like agro-waste valorization. Scenario-based risk management, including optimistic (6.8% GDP growth) and pessimistic (4% export contraction) projections, necessitates AI-driven supply chain mapping to navigate oil price swings and geopolitical tensions.

Policy harmonization via GIFT City’s IFSCA guidelines was advocated to advance tokenized commodities and align with the ICC’s digital standards, reducing cross-border friction. Addressing the MSME financing gap requires AI credit scoring and blockchain-enabled supply chain finance, mirroring anchor-buyer programs by Patanjali Foods and Olam Agri to support deep-tier suppliers. Collaborative governance, including public-private task forces, was proposed to dismantle data silos and upskill workforces in blockchain and carbon accounting, ensuring systemic reforms.

Majumdar concluded that India’s $5 trillion economy goal hinges on balancing supply chain opportunities with sustained investments in productivity, digitization, and ESG alignment amid global protectionism.

Majumdar stressed the urgency for India to diversify its export markets and product portfolios to mitigate risks from geopolitical fragmentation and protectionism. With global trade tensions triggering a tripling of trade restrictions since 2019, she highlighted India’s success in deepening partnerships with emerging economies (e.g., BRICS) and reducing reliance on traditional markets like China.

The “Identifying Challenges and Innovating Solutions” panel at GTR India 2024, featuring Saju Thomas Punnoose (RBI) and Sanchay Agrawal (Bank of America), emphasized rupee-based trade reforms as a cornerstone for reducing dependency on hard currencies and addressing liquidity challenges for exporters, with the RBI prioritizing mechanisms to settle cross-border transactions in rupees through standardized invoicing and settlement systems.

Discussions highlighted payment modernization initiatives, including blockchain integration at GIFT City and interoperability of India’s UPI with global platforms to streamline digital transactions, though gaps in cross-system compatibility remain. The RBI underscored regulatory coherence, advocating for accelerated adoption of the Model Law on Electronic Transferable Records (MLETR) to legalize digital trade documents like promissory notes, aiming to phase out paper-based inefficiencies. Panelists addressed inflationary pressures exacerbating trade complexity, with proactive measures like rupee invoicing helping insulate exporters from currency volatility and dollar shortages. Exporter protections were prioritized through policymaker-level reforms, including simplified KYC processes and expanded access to trade credit via platforms like PSB Alliance’s one-click supply chain finance model.

The session stressed collaborative governance between regulators, banks, and fintechs to harmonize digitization efforts, particularly in scaling AI-driven credit tools for MSMEs facing a $240B financing gap. GIFT City’s regulatory sandbox was positioned as a testing ground for innovative trade instruments, including tokenized commodities, to attract foreign investment. Challenges in deep-tier supply chain financing were acknowledged, with calls to replicate anchor-buyer programs like Patanjali Foods’ to extend liquidity to smaller suppliers. The RBI reiterated commitments to ease of doing business, including faster dispute resolution mechanisms and reduced collateral requirements for trade credit. Finally, the panel framed ESG compliance as integral to accessing Western markets, urging alignment of rupee trade initiatives with global sustainability standards to bolster India’s export competitiveness