EVOLVING & DYNAMIC INDIAN RETAIL SECTOR

The e4m RetailEX Conference, organized by the exchange4media Group, was a significant event that explored the latest trends and technologies reshaping the retail commerce landscape. The conference aimed to equip attendees with strategies to stay agile, innovate, and cater to evolving consumer demands in a fast-paced market.

The e4m RetailEX Conference, organized by the exchange4media Group, focus on the theme “Innovate, Adapt & Thrive: Shaping the Future of Retail Commerce.” The event delved into the latest trends and technologies reshaping the retail landscape, offering strategies for brands to stay agile, innovate, and effectively cater to evolving consumer demands in a dynamic market.

The e4m RetailEX Conference served as a vital platform for knowledge-sharing, networking, and collaboration among retail professionals, enabling them to navigate the evolving retail landscape with confidence and drive growth for their businesses.

The event featured a diverse lineup of industry experts and brand leaders who shared actionable insights and engaged in thought-provoking discussions on various aspects of retail marketing. Some of the key topics covered included:

The role of technology in transforming the retail experience: Speakers discussed how retailers are leveraging advancements such as AI, AR, and QR codes to create personalized, seamless, and engaging shopping experiences for consumers.

Innovative strategies for retail success: Industry leaders shared their experiences and successful approaches to staying ahead in a competitive market, including building strong brand identities, understanding customer needs, and embracing emerging trends.

The future of retail: Panel discussions explored the potential impact of future technologies, changing consumer behavior, and new business models on the retail industry, helping attendees anticipate and prepare for upcoming challenges and opportunities.

The e4m RetailEX Conference served as an essential platform for knowledge-sharing, networking, and collaboration among retail professionals, enabling them to navigate the evolving retail landscape with confidence and drive growth for their businesses.

At the presentation. – GenZs in India and their needs from brands by Sunder Balasubramanian , CMO, Myntra, delivered key insights about this demographic, debunking myths and highlighting opportunities for brands. His presentation revealed how GenZ is reshaping the online retail landscape through their unique shopping behaviors, growing financial independence, and substantial influence on household purchases.

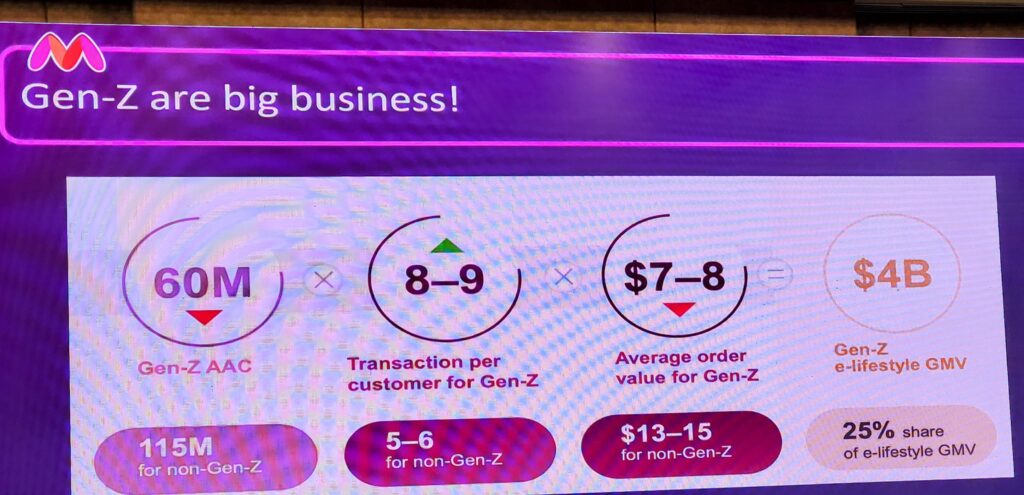

India’s GenZ population represents a massive opportunity for retailers, with numbers that indicate both current significance and future potential. According to Sunder Balasubramanian, India has a 200 million-strong GenZ population, with 60 million urban GenZ consumers already actively shopping online[4]. This demographic will be the core business and primary growth driver for many retailers in the coming years, as their financial independence and digital-first nature continue to evolve.

The online trend-first fashion market, particularly popular with GenZ consumers, is projected to grow significantly, expected to expand over 8x into a $5 billion market by 2028[. This forecast underscores the economic importance of understanding and catering to GenZ preferences in the retail space.

While GenZ is often associated with metropolitan areas, their influence extends well beyond. Balasubramanian noted that over 40% of Myntra’s GenZ customers come from tier-two markets, challenging the notion that this demographic is primarily urban-centric. “GenZ has no barriers because everyone’s digital-first. We can reach out to them across the country,” he stated, highlighting the opportunity for brands to connect with GenZ consumers regardless of geography.

One of the most significant insights Balasubramanian shared was challenging common misconceptions about GenZ’s spending power. Contrary to the belief that GenZ lacks financial resources, Myntra’s data paints a different picture. Approximately 30% of GenZ are already in the workforce, while 69% have some form of side hustle. “They are innovative in making money, whether through freelance gigs or becoming influencers. Their ability to spend is far greater than assumed,” Balasubramanian explained.

The financial literacy of this generation is also noteworthy, with 40% of National Stock Exchange (NSE) registered users being from GenZ. “They are not just earning; they are actively investing. While they may not be long-term savers, they are financially literate and eager to spend,” he pointed out.

The impact of GenZ extends far beyond their direct purchases. At least 25% of Myntra’s Gross Merchandise Value (GMV) in the lifestyle space is driven by GenZ buyers[4]. Moreover, they influence approximately 85% of household purchases, particularly in categories like electronics, technology, and fashion. “They are the chief decision-makers in their families,” Balasubramanian noted, emphasizing the multiplier effect of connecting with GenZ consumers.

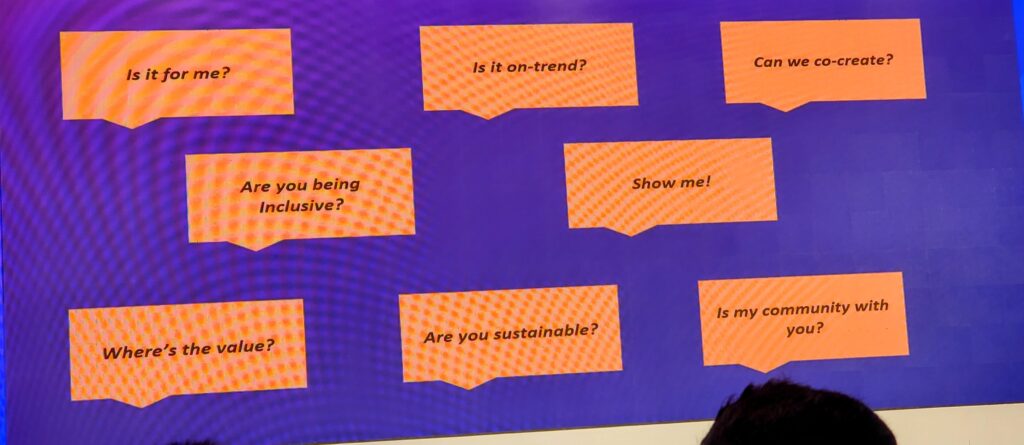

Perhaps one of the most valuable insights from Balasubramanian’s presentation was his emphasis that GenZ is not a monolithic group. “We identified eight different segments within this demographic, each with unique emotional and psychographic needs related to fashion,” he revealed. This segmentation has helped Myntra create personalized experiences that resonate with different GenZ subgroups.

This generation is particularly interested in whether they connect with the brand’s narrative and if it’s presented authentically. “Inclusivity is crucial for them, and they want to see brands that represent their community,” Balasubramanian added, highlighting the importance of representation and diversity in marketing to GenZ.

Technology plays a crucial role in how brands engage with GenZ consumers. Myntra has developed innovative features specifically designed to appeal to this tech-savvy demographic. One such innovation is “Fashion GPT,” a conversational search feature that addresses how GenZ searches for fashion items.

Artificial intelligence and machine learning are increasingly central to Myntra’s strategy for engaging GenZ. “Everything that we do from a Performance Marketing perspective… is all AI-based engines that work on meta and Google,” Balasubramanian shared, adding that AI will continue to impact various aspects of retail, from data analytics to generative AI applications.

Ajay Gupta, Founder, Ching’s Secret & Senior Advisor to the CEO, Tata Consumer Products Ltd spoke on the The Power of Localized FMCG: Achieving Scale Without Losing Identity.

Localized FMCG strategies play a pivotal role in ensuring the global scalability of brands without diluting their identity. By embracing cultural relevance and tailoring products and messaging to suit local tastes, companies can forge stronger bonds with their customers, paving the way for sustainable growth and long-term loyalty.

To achieve this, brands must strike a balance between maintaining their core essence and adapting to the subtleties of different markets. By understanding regional preferences, customs, and cultural nuances, companies can create more meaningful and authentic connections with consumers across the globe.

Ajay offered a masterclass in strategic growth. Gupta’s journey—from pioneering Desi Chinese cuisine in Indian households to navigating a landmark ₹5,100 crore acquisition by Tata—reveals how intuition, cultural alignment, and grassroots innovation enable brands to achieve national scale without diluting their core appeal. His insights challenge conventional scaling paradigms, emphasizing trust, adaptability, and consumer-centric localization as pillars of sustainable growth.

India’s FMCG sector, valued at over $110 billion in 2025, thrives on regional diversity and shifting consumer preferences toward convenience and authenticity. Localized brands that resonate with hyper-specific cultural or culinary niches have emerged as key growth drivers, outpacing generic multinational offerings. This trend reflects deeper socio-economic shifts: rising disposable incomes, urbanization, and a young population seeking products that align with their regional identities while offering modern convenience.

Gupta’s Ching’s Secret epitomizes this movement. By identifying the ubiquity of Indian-Chinese street food, he transformed a roadside staple into a packaged goods empire. “We started as a niche business, but that niche became mass because we addressed an unmet need—authentic Desi Chinese flavors for home cooking,” Gupta explained at the conference[1]. This approach capitalized on India’s $21,400 crore market for global cuisine-inspired packaged foods, a category growing at 12% annually due to younger consumers experimenting with hybrid flavors.

Localized FMCG brands face a unique challenge: scaling beyond their regional or cultural origins without alienating early adopters. Gupta’s strategy centered on *product democratization*—making premium or specialized offerings accessible to broader audiences. For instance, Ching’s Secret initially distributed free samples to street vendors, embedding the brand within the very ecosystem that inspired its creation. This grassroots adoption created organic demand, with 40% of early sales coming from tier-2 cities, proving that localization need not limit geographical reach.

A recurring theme in Gupta’s conference address was the limitations of traditional market research. “Intuition often trumps data when entering uncharted categories,” he asserted, recalling how established players dismissed packaged Desi Chinese as a “niche within a niche”. Without precedent in the Indian FMCG market, Gupta relied on observational insights—not surveys—to identify opportunities.

The ₹5,100 crore acquisition of Capital Foods by Tata Consumer Products in 2024 marked a watershed for localized FMCG brands. Gupta emphasized that scaling required a partner aligned with the brand’s cultural DNA: “Tata’s trust equity and distribution reach accelerated our growth, but crucially, they understood our identity wasn’t negotiable”[1]. The phased acquisition—75% upfront, 25% over three years—allowed gradual integration, preserving Ching’s Secret’s operational autonomy while leveraging Tata’s pan-India logistics.

Post-acquisition, Gupta retained creative control over product development, ensuring that new launches like ready-to-cook Hakka noodles stayed true to street-food authenticity. Tata’s role focused on backend synergies:

– Distribution: Expanding from 1.2 million to 3.5 million retail outlets within 18 months.

– Export Channels: Introducing Desi Chinese variants for NRIs in the US and Middle East.

– Sustainability: Adopting Tata’s eco-friendly packaging initiatives without reformulating core recipes.

This model demonstrates how localized brands can harness corporate infrastructure without compromising their unique value proposition.

Gupta projects that Ching’s Secret will become a ₹1,000 crore brand by 2027, driven by:

– Portfolio Expansion: Venturing into frozen Desi Chinese snacks and plant-based protein variants.

– Tech-Enabled Personalization: AI tools to recommend recipes based on regional preferences.

– Global Diaspora Markets: Targeting 30 million NRIs through Tata’s international networks.

Ajay Gupta’s journey reframes localization not as a constraint but as a scalable competitive advantage. In an era where 68% of Indian consumers prefer brands that celebrate regional identities.

Gupta said, “The future belongs to brands that think global but act hyper-local—those that scale without sanitizing their soul”. For incumbents and startups alike, this philosophy offers a roadmap to thriving in India’s complex, sentiment-driven FMCG landscape.