LOGISTICS POWERING INDIA TO $25 TN ECONOMY

As India attempts to achieve its lofty economic goals, including a GDP of US$ 5.5 trillion by 2027, the restructuring of its logistics industry becomes an urgent need. The logistics industry supports different industries, including manufacturing, agriculture, and e-commerce, presenting both obstacles and possibilities. Logistics is recognised as the economy’s backbone, ensuring an efficient and cost-effective flow of commodities that other business sectors rely on.

Messe Muenchen India hosted the 10th anniversary edition of air freight India from February 14 to 16, 2024, at the Jio World Convention Centre in Mumbai. Air cargo India has developed as a top trade show for the air freight business, bringing together all of the community’s key participants, including airlines, airports, cargo handlers, GSAs, and IT service providers. This year, included over 300 businesses, 800 delegates, and 12,000 participants from 50+ countries, marked a 24 percent increase in exhibition space compared to the previous edition, and cemented its status as India’s largest transport and logistics trade show. The response, with a fully scheduled show, revealed great interest from both international and domestic air freight solution suppliers.

The infrastructure industry is critical to driving India’s economic growth and development. As the country progresses towards becoming a worldwide economic powerhouse, the necessity for strong infrastructure becomes more obvious. The government’s efforts to promote ‘Make in India’ and develop India into a ‘global manufacturing powerhouse’ are expected to boost the manufacturing sector, which contributed 15.3% of GDP in FY22. India can gain considerable benefits from the change in industrial bases by building top-notch infrastructure and recruiting corporations to set up operations, making it a prominent global manufacturing hub.

In a globally competitive environment, operational and logistical efficiency dictates the location and transportation of commodities. India must reorganise its freight and logistics networks based on the location of production and consuming activities, resulting in the hub-and-spoke models required to optimise freight and logistics performance.

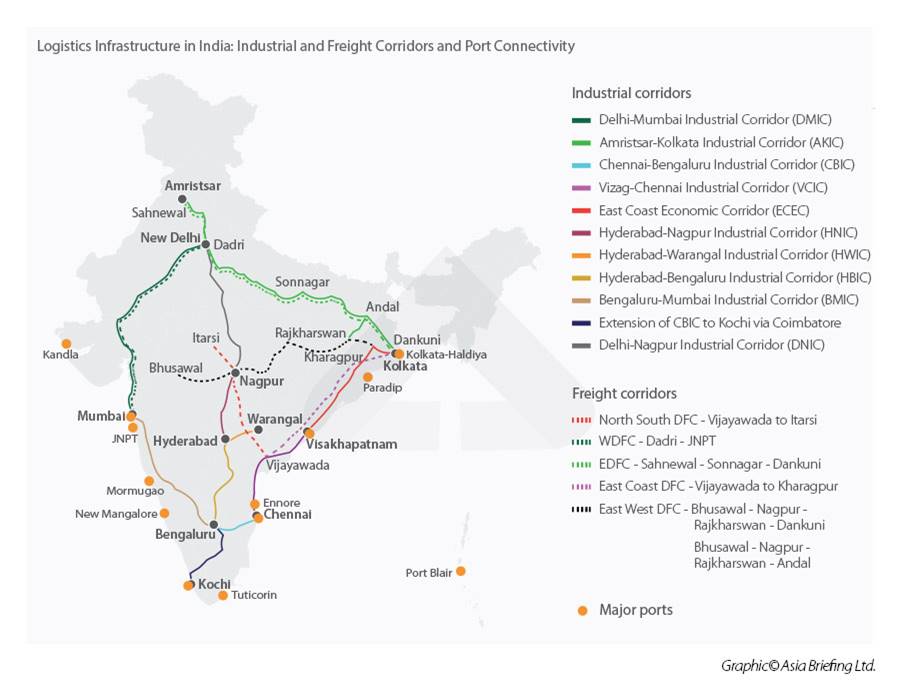

The transport logistic expo in India will enhance the industry’s capabilities by encouraging key players to share best practices and information. “India’s ambitious goal of reaching $2 trillion in exports by 2030 hinges on building a world-class logistics network to complement existing investments in infrastructure expansions such as the launch of new airports, seaports, highways, industrial corridors and dedicated logistics parks,” says Bhupinder Singh, CEO, Messe Muenchen India.

During the show, visitors and delegates from several countries displayed their products in person, made new contacts, and conducted business. This was a wonderful opportunity to see how India’s dominant air freight business operates firsthand. Several subjects were presented at the conference, including new, creative technological techniques and infrastructure. The event was designed for air cargo experts who wanted to learn about new business prospects, worldwide views, and effective networking platforms.

Air Cargo India 2024, the industry’s largest event, featured a range of events, keynote speeches, panel discussions, and interactive workshops. The conference will cover all aspects of air freight, including technology, logistics, and much more.

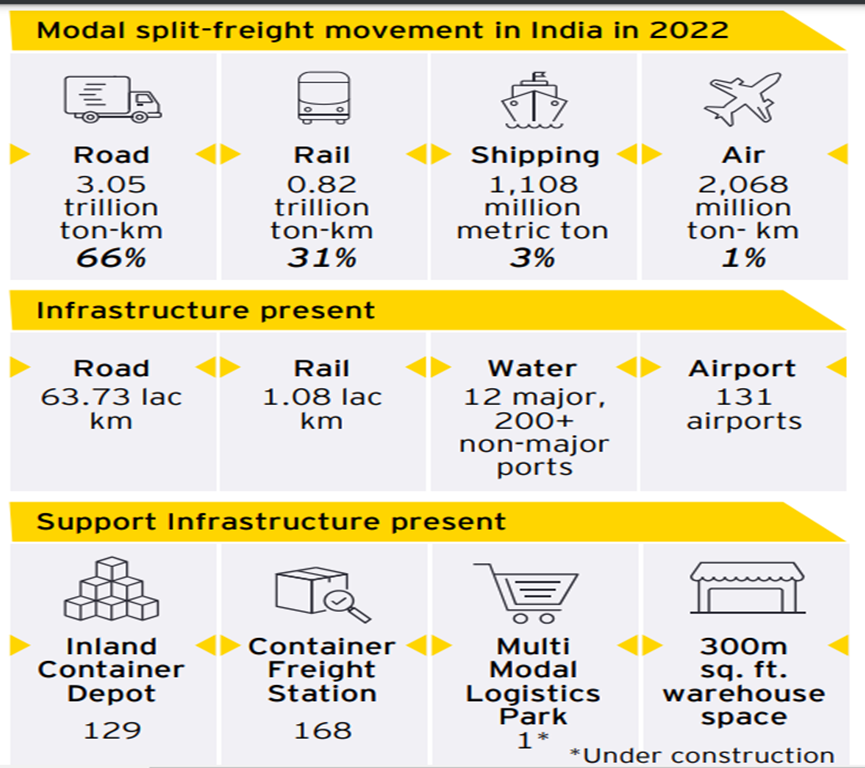

India’s transportation and logistics landscape (above). Source- PBI, Ministry of shipping, Ministry of civil aviation, Niti Aayog.

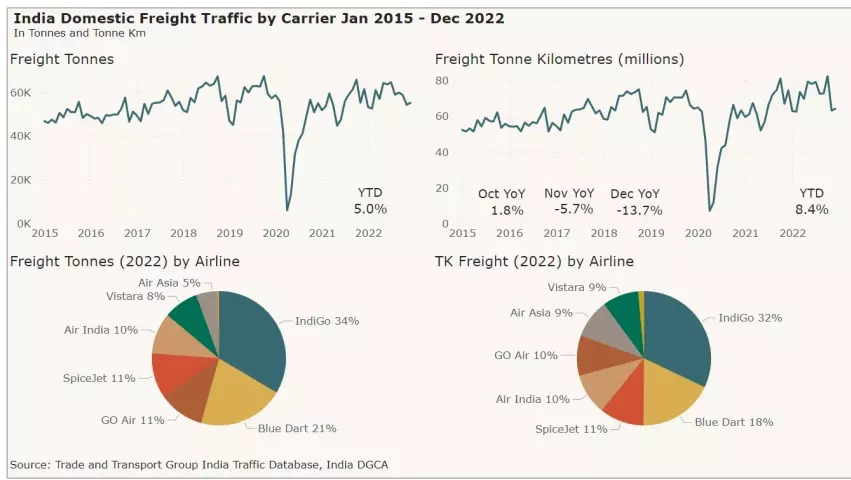

Road transport accounts for 66% of India’s freight traffic. Rail accounts for 31%, followed by shipping (3%), and air (1%). India has considerable support infrastructure for cargo transit, including 129+ in-land container depots, 168+ container goods stations, and over 300 m sq. ft. of warehouse area.

As logistics is critical to economic growth, and any changes to the country’s logistics ecosystem have a beneficial commercial impact, ranging from operational efficiency to growing supplier networks to increasing last-mile reach to satisfy market demand. Furthermore, applied technological innovation and data-driven insights may help businesses optimise their supply chains, allocate resources more efficiently, and provide great customer experiences.

In the past five years, India has risen to 38th out of 139 nations on the Logistics Performance Index, thanks to advancements in technology, logistics, and business ease. The LPI index measures countries on six aspects of logistics performance, including infrastructure quality, customs efficiency, logistics services quality, international shipment arrangements, on-time delivery frequency, and shipment tracking. In 2018, India placed 44th on the index, a significant increase from 54th in 2014.

India’s expected GDP growth to US$26 trillion by FY48 (US$6 trillion by FY2030) and push to raise goods exports to US$1 trillion by 2030 would boost demand for the logistics industry.

The transport and logistics industry in India serves as the foundation for the country’s rapid expansion during the next 25 years. Manufacturing growth requires efficient and technology-enabled supply chain solutions to serve global firms, India has the potential to become a reliable supply chain partner for both local and international commerce by providing efficient and sophisticated solutions.

The logistics industry understands the value of expediting freight flow in a fast-paced environment. As a result, businesses are eager to integrate new technology for complete management and strategic planning in order to meet expanding expectations.

“Additionally, we are also witnessing widespread investments to build on India’s digital capabilities and skill development for the air cargo and transport logistics sectors. This edition of air cargo India will continue these dynamic conversations around multimodal transport, with a special emphasis on the sustainability initiatives of the air cargo industry.” Robert Schönberger (above left), Global Industry Lead, transport logistic exhibitions, Messe München adds: “We are truly delighted to offer our customers a multimodal experience at this edition, and we expect these co-located exhibitions to unlock new business opportunities across India’s vast logistics landscape, including air, sea, rail, and road connectivity. This 10th anniversary edition will be a milestone not only for air cargo India but also for all our clients and partners from the Indian and global logistics community. Therefore, we hope to see more energising ideas, innovations, and collaborations at this edition that will serve as a powerful launchpad for transport logistic India.”

As India grows as a global import-export centre, the exhibition provides a unique venue under the National Logistics Policy, which encourages connectivity through highways, seaports, and air cargo facilities. The strategic co-location aligns with India’s growth of multimodal logistics parks and the G20 summit’s focus on infrastructure.

In the panel discussion – 10 million tonnes by 2030 – is the runway getting ready for such ambitious target?

Roland Weil, VP – Sales, Cargo at Frankfurt Airport, moderated this panel discussion and began by discussing his three-decade expertise in the Indian aviation business, as well as its future prospects.

Weil emphasised three major areas of effort that are critical to meeting the target: growing prospects, airport infrastructure, and airline preparedness to accept the demand spike.

Responding to this key issues, Ramesh Mamidala, Head of Cargo at Air India, acknowledged that the expansion plans are ambitious, he believes there must be a dose of reality for the country’s dream to come true. Mamidala said that Air India’s cargo business is currently moving over 3.5 million tonnes as of today, with more growth potential to be reached under the plans developed by the carrier’s new owner Tata Group.

Mamidala further stated that Air India is on track to reinvigorate its fleet mix, with new contracts for wide and narrow body aircraft on the books, including the Airbus A350, with deliveries beginning in early January 2024.

Yashpal Sharma, Managing Director of Skyways Group and President of ACFI, added: “Since the privatisation of Mumbai and Delhi airports in 2006, the cargo industry has grown multi-fold year on year, with an emphasis on increases in manufacturing capacity, logistics infrastructure, and a policy shift to boost air cargo movement.”

Sharma went on to say that there is still a long way to go to reach the 10 million mark by 2030, with current levels at 3.5 million tonnes in 2024, despite considerable increase in electronic manufacturing and agricultural production over the last eight years. He was optimistic that the specified aim could be met by increasing capacity for shippers through new airports and modernising current facilities.

Cathay freight’s Director, Tom Owen, stated that “there are opportunities that can be exploited by opportunities like capacity availability, liberal region with seamless cargo movement, and area of productivity and digitalisation.” However, Owen felt that a lack of excitement to capitalise on this potential would hurt the efficiency of the supply chain business, harming aviation freight operations. Owen went on to say that Hong Kong International Airport’s route to becoming a cargo hub required both work and a general commitment to accomplish its goals, resolving problems as they arose.

Dennis Lister, SVP Product and Innovation at Emirates SkyCargo, stated that “the world is changing” and that it is time for the industry to adapt to these new trends. Emirates SkyCargo transports around 2600 metric tonnes of cargo every week via more than 160 flights outside of India, with perishable commodities accounting for 28%.

The Indian air cargo business has a strong thirst for expansion, but the obstacles that are impeding this growth must be addressed as soon as possible to avoid delays in meeting the 2030 target.

Manoj Singh, Chief Cargo Officer of Adani Airport Holding Company, stated that in recent years, comprehensive policy design, digital infrastructure, and an extensive skill pool have added value to the 2030 aim.

India’s GDP is increasing at a rate of 6.5% to 6.85% year on year, with the goal of exporting cargo worth more than USD$2 trillion through its 106 clusters by 2030, resulting in additional development in the airfreight business.

Singh went on to say that the Adani company, which has taken over six airports in India, is focusing on expanding Mumbai Airport capacity as well as the New Navi Mumbai Airport, which is expected to transport over 4 million tonnes – one-third of India’s cargo. The business intends to enhance its approach by targeting niche items, with the e-commerce market predicted to add 2.5 million tonnes and hit the USD $400 billion mark by 2040.

Sanjeev Edward, CEO of Cargo & Logistics GMR Group, stated that “this is a time of growth for India’s markets.” India is aligning itself with the rest of the globe, becoming the second largest industrial hub and aiming to be the biggest consumer market by 2030.

“This is the time to gear up and grow India’s capacity with added investments in infrastructure and an emphasis on making primary airports like Mumbai, Delhi, Hyderabad and Bengaluru cargo hubs.

Currently, India’s airports have a total air cargo carrying capability of about 6.5 million tonnes. To capitalise on the potential of this emerging sector and accommodate a jump to 10 million tonnes by 2030, the Ministry of Civil Aviation, in collaboration with the Airports Authority of India (AAI), is leading infrastructure-building activities. These projects include the development of new cargo terminals, such as integrated, multimodal, and specialised facilities. Furthermore, initiatives are ongoing to expand and modernise existing ports, as well as the strategic development of cargo transshipment hubs.

According to a recent Research and Markets prediction, India’s air freight market is predicted to be $13.08 billion in 2023 and $17.22 billion by 2028, rising at a CAGR of 5.65%.

This increase is due to strategic measures concentrating on the construction of airport infrastructure, logistics parks, and substantial road connection projects throughout the country. The production-linked incentive (PLI) plan, which covers 15 industrial industries, further boosts the expansion of air freight operations in India.

On the one hand, as the global air cargo market is expected to grow significantly between 2024 and 2031, India has seized this opportunity to not only develop but also become one of the top five freight markets by 2025, with an ambitious target of 10 million tonnes for Indian air cargo by 2031, up from the current 3 million tonnes.

According to industry analysts, the Indian air cargo business has performed very well when compared to the worldwide air freight market. Most Indian air freighters predict a more resilient performance in 2024.

Globalisation and e-commerce trends are creating new prospects for growth. Potential challenges include gasoline price volatility and geopolitical uncertainty. To achieve a favourable outcome, priority areas will include rigorous cost control, route optimisation, and customer-centric services. India’s air cargo business is undergoing substantial technological revolution, with sustainability at the centre of supply chain management. This change is marked by innovations and improved logistics solutions aimed at improving operating efficiency, lowering costs, and increasing overall competitiveness.

The Indian air cargo business is fueled by increasing demand from allied industries such as e-commerce, medicines, manufacturing, electronics, and agriculture, and it is now undergoing substantial expansion and transition, with a strong emphasis on technology and innovation.

The panel also reviewed the constraints of securing transhipment share in the Indian air cargo industry, as well as the causes for delays in the cargo cycle eco-system. Challenges such as a lack of digitalization, extensive red tape processes, a lack of regulatory systems, and general infrastructure limit the market’s potential. The primary approach for overcoming these issues is to establish a multimodal transportation and freight moving system.

Key technologies such as artificial intelligence (AI), the internet of things (IoT), blockchain, and machine learning are set to transform logistics operations, ushering in a more environmentally friendly and efficient future. This has resulted in greater product tracking and visibility, less waste and emissions, and increased efficiency. These technical developments have enabled improved cargo tracking, shorter transit times, and optimised routes, resulting in lower fuel usage and emissions.

Upgrading existing global and regional airports and constructing new airports with specialised cargo terminals would increase cargo volumes and transportation. Improving road and rail connectivity, creating MMLPs, sophisticated warehousing techniques, expediting customs clearing operations, decreasing paperwork, and implementing digital solutions would all assist. E-commerce, supply chain globalisation, and rising demand for air cargo services from industries such as pharmaceuticals, manufacturing, agriculture, and electronics will be major growth drivers. The possibility for perishable goods has contributed significantly to this growth.

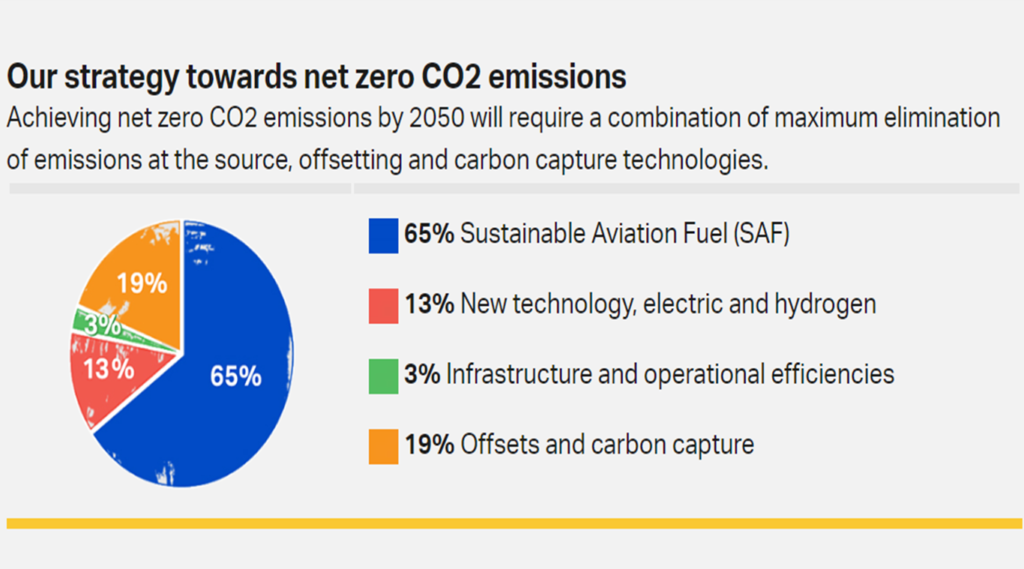

Sustainable aviation fuels (SAF) are the foundation of our decarbonisation initiatives. Airlines and shippers have demonstrated high demand for Sustainable Aviation Fuels (SAF), which are estimated to account for about 65% of the mitigation required to achieve net zero carbon emissions by 2050.

The panel discussion on “Air cargo’s path to sustainability,” moderated by Danita Waterfall-Brizzi, Principal Cargo & Logistics Consultant, Hospitio Consulting & Professional Services. This panel discussed the industry’s commitment to reaching net zero emissions by 2050 and the practical actions required to achieve this lofty objective. The debate focused on the varied road towards sustainability in air cargo, from assessing the viability of industry-wide sustainability commitments to developing effective methods for waste reduction and environmental protection. The panelists were – Kiran Jain, Chief Operating Officer, Noida International Airport,

Adrien Thominet, Executive Chairman, ECS Group, S. Burak Omerogluğlu, VP Middle East and South Asia, Turkish Cargo, Vivek Chopra, Senior Director – Airfreight India & Indian Subcontinent, DB Schenker and Charles Wyley, EVP MEAA, Menzies Aviation.

The panel discussed on the air freight business which has grown as an important actor in a world where timely delivery can mean the difference between life and death. As air cargo has become an essential component of global logistics, rapidly moving vaccinations, important pharmaceuticals, and e-commerce items, the sector aims for net-zero carbon emissions by 2050, powered by sustainable fuels, innovative technology, and efficiency gains.

Airlines have pledged to attaining net-zero carbon emissions by 2050, demonstrating the industry’s commitment to minimising its environmental effect and tackling the pressing issue of climate change. IATA and the International Civil Aviation Organisation (ICAO) help airlines reach lofty sustainability targets, while airports provide incentives for adopting SAF. Airlines are also upgrading their fleets and boosting their usage of SAF.

Addressing the environmental effect of air cargo requires a multifaceted approach that focuses on fuel improvements, operational efficiency, and technical developments. Because battling climate change is critical, all airlines must begin employing more sustainable options available now.

According to IATA, SAF has the potential to generate over 65% of the emission reductions needed to achieve net-zero carbon emissions by 2050. Sustainable aviation fuels (SAF) are emerging as a game-changer in reducing the environmental impact of the aviation industry. These bio-based fuels, unlike traditional jet fuel, boast a significantly lower greenhouse gas footprint. The video highlights SAF as a concrete step towards a more sustainable future for air travel. However, large-scale implementation requires collaboration. Partnerships between industry players and governments are crucial to develop and deploy SAF effectively. Furthermore, supportive government frameworks are essential to incentivize and accelerate the adoption of this promising technology.

When utilised neat, SAF decreases greenhouse gas emissions by up to 80%, across the fuel’s life cycle, compared to fossil jet fuel. Demand for SAF is certainly on the rise, as more airlines commit to replacing old fossil fuels with sustainable alternatives in the coming years.

The air cargo sector seeks to achieve net-zero emissions by 2050 through a joint effort that includes airlines, manufacturers, and regulators. The air freight business is making progress towards sustainability with innovations like as sustainable fuels and electric/hydrogen propulsion.

According to the International Air Transport Association (IATA), Sustainable Aviation Fuel (SAF) may account for about 65% of the emissions reductions required by aviation to achieve net zero emissions by 2050. To fulfil demand, output will need to be increased dramatically. The greatest increase is projected in the 2030s, as regulatory support expands globally, SAF competes with fossil paraffin, and reliable offsets become rare.

Thirty-eight of the world’s largest airlines have committed to achieving net-zero emissions by 2050 or earlier. Furthermore, about 30 have established some type of SAF implementation objective, such as 10% of fuel usage by 2030. While the United States and Europe continue to dominate the industry, other countries, like Canada, China, and Japan, are establishing policies, roadmaps, and objectives to encourage domestic SAF adoption.

Above is IATA’s strategy for SAF adoption.

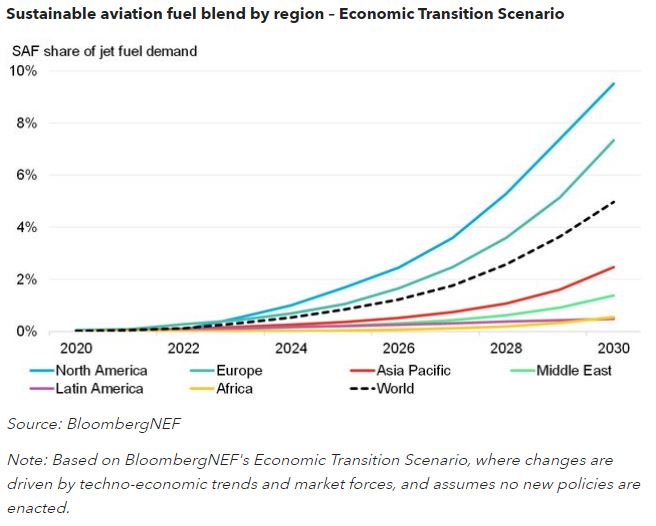

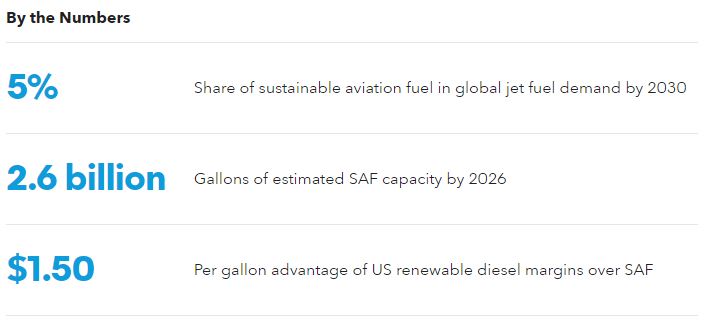

BloombergNEF’s Economic Transition Scenario predicts that demand for SAF would reach 7 billion gallons, or 5% of global jet fuel demand, by 2030, with changes driven by techno-economic trends and market forces and no new legislation imposed. In BNEF’s Accelerated Policy Scenario, demand hits 10.6 billion gallons, or 7.5% of jet fuel consumption.

Despite increased interest and objectives from the aviation sector, SAF supply remains limited and concentrated among a few suppliers. Several initiatives to bring new capacity online are planned during the next five years.

The exponential expansion of e-commerce has led to a considerable increase in demand for air freight transportation. As more people purchase online, the necessity for rapid and dependable delivery services has grown critical.

The panel, titled Exploring the Future of Ecommerce Logistics!, discussed the changing environment of ecommerce logistics and order fulfilment, from B2B to B2C to D2C to C2C. The rise of internet purchasing has transformed consumer behaviour, posing both difficulties and possibilities for firms globally. As ecommerce continues to disrupt the retail scene, the panel looked at how fast changes in online purchase patterns, both locally and globally, are influencing order fulfilment tactics and package delivery logistics.

India’s e-commerce business is on the rise, owing to increased internet penetration, a growing middle class, and a young generation that prefers digital purchasing. The COVID-19 epidemic increased this trend, encouraging more customers to purchase online for a broader range of items, including necessities, necessitating dependable and fast delivery options.

The spread of e-commerce to tier 2 and tier 3 cities is nothing short of remarkable. According to a RedSeer Consulting analysis, these cities are driving the next wave of growth in India’s e-commerce sector, accounting for a sizable share of total online transactions. Over CY20-30, Tier 2+ cities will contribute 88% of new online shoppers and $150 Bn in cumulative incremental online retail GMV.

Air freight has long been the favoured method of transporting time-sensitive and high-value items in the e-commerce sector. The business has lately seen an increase in demand, mostly due to the e-commerce boom. As a result, air freight rates have risen, and capacity has tightened. Freight forwarders should expect these trends to continue in 2024 as e-commerce companies attempt to match their consumers’ demands for fast delivery.

Air cargo has been critical in achieving these delivery deadlines, particularly for time-sensitive or high-value items. The air cargo business in India has been revitalised during the epidemic, with a renewed emphasis on increasing air freight capacity and cutting turnaround times.

E-commerce caters to a wide range of client wants and preferences, necessitating greater flexibility from logistics providers, such as giving several delivery alternatives (e.g., pick-up sites, lockers), returns management systems, and real-time tracking.

E-commerce expansion has considerably increased the volume and complexity of logistical operations. Traditional supply chain models which were developed for bulk shipments to retail locations, now handle direct-to-consumer deliveries, which are typically smaller and more frequent. This transition needs a more flexible, responsive, and customer-centric approach to logistics.

Technology adoption in the Indian air cargo market is expected to increase, with more enterprises adopting AI, data analytics, and IoT to optimise cargo operations. These technologies can assist estimate demand, manage inventories, and improve the overall efficiency of air freight operations.

Technology adoption in Indian air cargo sector is revolutionizing the e-commerce industry by:

Improving Operational Efficiency: Automated processes and digital tracking systems ensure faster turnaround times, improved accuracy, and better inventory management for e-commerce companies.

Enhancing Customer Experience: Real-time tracking of shipments, proactive notification of delays or delivery updates coupled with seamless integration with their logistics partners are improving the overall customer experience and boosting customer satisfaction.

The outlook for air freight and e-commerce in India for 2024 is quite positive, with significant development prospects for airlines. Airlines should not only improve operating efficiencies by capitalising on technology improvements, extending service offerings, and aligning with environmental aims, but also place themselves at the forefront of India’s e-commerce growth.

The Indian e-commerce business is expanding rapidly, with the total market size expected to reach 117 billion US dollars by 2024. Smartphones had the largest market size, with a value of $35 billion. This emphasises the growing importance of e-commerce in the Indian retail environment, indicating a shift in customer behaviour and inclinations towards online buying.

The existence of domestic and foreign enterprises has resulted in severe rivalry in the e-commerce market. This expansion is fueled by rising smartphone adoption, internet usage, and other favourable market conditions.

According to a research released by investment promotion and facilitation agency Invest India, India’s e-commerce sector is primed for a massive increase by 2030, with an anticipated 500 million customers. The survey predicted a significant increase to $325 billion by 2030, with the nation’s digital economy likely to reach an astonishing $800 billion at the same time.

India’s online shopping business is currently valued at $70 billion and accounts for around 7% of the country’s entire retail market, providing a significant possibility for expansion. Several reasons, including as increased internet penetration, low-cost internet services, and a significant growth in rural smartphone users, are projected to move the industry forward in the next years.

The panel Global Unified & Aligned Quality Processes in India’s rapidly expanding pharmaceutical export markets, moderated by Frank Van Gelder, MD, Mediconed Consultancy & Secretary General, Pharma.Aero and Tushar Jani, Group Chairman, Cargo Service Center India Private Limited, the panellists – Netka Hohlfeld – Department Head Life Science and Healthcare Logistics, DACHSER Dimitrios Jimmy Nares – Section Chief – Aviation Marketing, Miami-Dade Aviation Department, Miami International Airport, Rashmi Karnad – Manager Climate Control Product – Pharma, Qatar Airways, Samuel Speltdoorn – Cargo Business Development Manager, Brussels Airport Company, Ugrasen Singh – Associate Director – Imp / Exp and Indirect Procurement, Vikas Rebello – Head Logistics, India APAC, Teva Pharmaceuticals, tackled the pressing need to address the consistent and reliable supply for the demanding rapid increase in exports, particularly to the United States, for assuring high-quality pharmaceuticals, which is very critical. The debate focused on collaborative efforts across businesses to ensure high standards, notably in air freight operations for temperature-sensitive items such as vaccinations.

However, increasing accountability brings a set of issues that have loomed over the Indian pharmaceutical sector in recent months, with the World Health Organisation (WHO) highlighting concerns about the quality of pharmaceutical goods as well as the robustness of the supply chain.

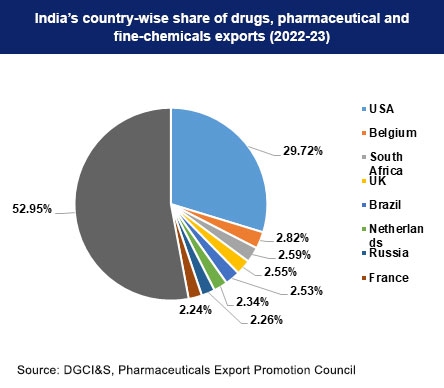

India has emerged as a worldwide pharmaceutical sector leader, notably in terms of medicinal exports. In the post-Covid period, India has seen a startling increase in pharmaceutical exports, with a 25% growth rate bringing the total value to USD $27 billion. The United States is the most strategic and essential trading partner for pharmaceutical exports, accounting for more than 10% of total production exported from India. India’s pharmaceutical sector is the world’s third biggest by volume and 13th largest by value, with over 60,000 generic pharmaceuticals produced over 60 therapeutic categories.

Frank Van Gelder, Secretary General of Pharma.Aero highlighted the worldwide pharmaceutical business is currently valued USD $1 trillion, with logistical expenditures accounting for 7% of that total, and a compound growth rate (CGR) of more than 6.56% over the next 20 years. The airfreight business accounts for around 3.59%, contributing 5.58% to airline income.

India’s largest export partner is the United States, and air cargo accounts for 13% of volume but 73% of value.

Speaking at the occasion, panellist Samuel Speltdoorn, Cargo Business Development Manager at Brussels Airport Company, stressed that the air cargo community must be developed with an emphasis on transparent communication and a wholly distinct Pharma Cluster.

Jimmy Nares, Section Chief – Aviation Marketing at the Miami-Dade Aviation Department, Miami International Airport, agreed with Speltdoorn on the importance of continuing to develop and engage stakeholders and the community in order to achieve the aim of managing pharmaceutical logistics. Nares further stated that “the systematic approach to ecosystem and stakeholder development is mandatory and collaboration amongst the partners will be the key to overcome any challenges.”

In discussing the regulatory environment, the panel emphasised the importance of developing global openness and focusing on transhipment movement in order to reap the benefits of the pharmaceutical freight ecosystem.

According to Netka Hohlfeld, Department Head Life Science and Healthcare Logistics at Dachser, “the issues are not only limited to the regulatory framework but with the quality consistency as well.” Supply chain, market access, trade agreements, bi-lateral ties, and partnerships were all important aspects in addressing the obstacles.

Rashmi Karnad, Manager Climate Control Product – Pharma at Qatar Airways, also agreed on the need of bringing the community together to address the issues of the whole pharmaceutical cargo life-cycle.

Vikas Rebello, Head Logistics, India APAC at Teva Pharmaceuticals, stated in his talk that the crucial component for the pharmaceutical sector is delivering the medicine from the plant to the correct patient in total coordination with logistic partners. However, the most important prerequisite for this cycle is effective communication and stakeholder participation.

Closing the panel discussion, all participants agreed that digital advances, as well as research and development in the logistic environment, are essential for maintaining acceptable quality control and improving the entire logistical infrastructure of India’s cargo business.