TOKEN2049 & TELEGRAM SUPERCHARGE DUBAI WEB3

TOKEN2049: the top cryptocurrency event’s inaugural Dubai conference, held from April 18 to 19, 2024, was a record-breaking triumph. Tickets for TOKEN2049 Dubai sold out approximately three weeks before the event, resulting in a packed house of 10,000 guests. Despite the pouring downpour, guests attended an incredible array of panel discussions, keynotes, workshops, and special networking opportunities.

TOKEN2049 Dubai hosted 90% foreign participants from more than 160 nations. The worldwide crypto community turned out in full force to participate, demonstrating Dubai’s rising position as a hub for crypto innovation. The worldwide participation also confirmed TOKEN2049 as the must-attend industry event on the crypto calendar.

Alex Fiskum, Co-Founder of TOKEN2049 said: “This week we witnessed the determination of the crypto industry first hand. Our team worked around the clock to ensure that the conference proceeded without any disruptions, maintaining the highest standards of hospitality for our attendees. Our programme proceeded and our doors opened as planned, welcoming attendees to a comfortable, immersive, and action-packed event. We are immensely proud of everyone who contributed to making TOKEN2049 Dubai an overwhelming success.”

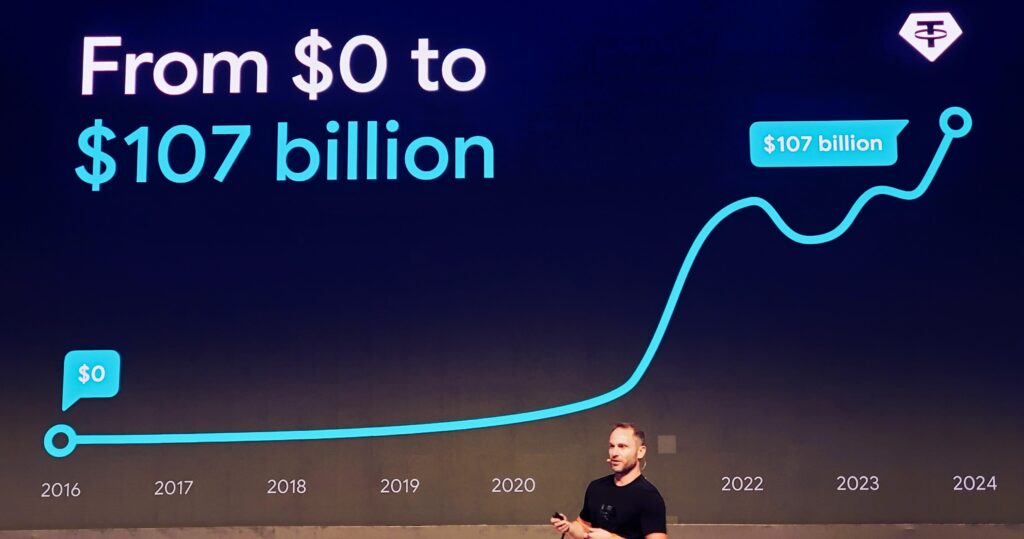

Pavel Durov, the visionary CEO of Telegram; Richard Teng, CEO of Binance; Paolo Ardoino, CEO of Tether; and Arthur Hayes, Co-Founder of BitMEX, were among the 200+ leading industry voices who took the stage to share their insights, discuss the most prevalent topics in Web3, and reveal exciting news announcements.

Some standouts include Tether and Telegram’s joint announcement onstage that USDT will launch on The Open Network (TON) and Telegram wallet; Polkadot’s Gavin Wood introduced a new JAM chain graypaper; Berachain announced a collaboration with Google Cloud; and Telos announced a partnership with Ponos Technology to develop a hardware-accelerated Ethereum L2 zkEVM network, among many other groundbreaking announcements.

Fiskum continued: “We have received overwhelmingly positive feedback from all participants across TOKEN2049 Dubai. Energized by this success, we now shift focus to prepare for the industry’s largest event of the year — TOKEN2049 Singapore, taking place on September 18-19 before the Formula 1 Grand Prix weekend. TOKEN2049 Singapore will welcome 20,000 attendees to the iconic Marina Bay Sands, continuing to set new standards for the industry.”

TOKEN2049 Dubai will return in 2025, delivering an even more immersive experience for influential industry leaders, Web3 developers, global businesses, and tens of thousands of cryptocurrency fans.

TOKEN2049 is hosted annually in Dubai and Singapore. For more information and updates on TOKEN2049, please visit: https://www.token2049.com. TOKEN2049 Singapore, which continues to grow, will return in September 2024 as the industry’s largest international event of the year, with 20,000 people.

Durov described how regular Telegram users may utilize Toncoin (TON). Beginning April 19, the first TON payments for advertising to Telegram channel admins will be made. In addition, beginning next week, users will be able to tip administrators in TON, with content creators receiving a share of the proceeds.

Purchasing and selling stickers in TON as NFTs will also be available, with sticker creators receiving 95% of the profits. Telegram will also feature mini-applications where users may buy content using cryptocurrency. Telegram users may also share TON with other people in their conversations.

“Imagine if someone owned this sticker as an NFT when it came out a few years ago. I think the price increases with the challenge. What we’ve experienced with again, stickers are very, very popular.”

The creator of Telegram stated that messenger users would be able to enter into their accounts using bitcoin wallets. In addition, users will soon be able to register the rights to an account’s name, allowing them to sell it if they desire. According to the Telegram creator, all advancements will be available to all users, and no programming knowledge will be necessary to utilize the new features.

“For the first time in social media history, you can directly own your username, sell it, put it up for auction, buy multiple usernames, and attach them to your account. “ Pavel Durov, Telegram Founder

The Open Network (TON) Blockchain launched in April 2024, followed an exceptional user engagement of over 1 million Monthly Active Users (MAUs) in March 2024. The TON Blockchain and Telegram have a strong relationship, having evolved through legal difficulties and strategic pivots since 2017, when Telegram founders Pavel and Nikolai Durov introduced the previously called Telegram Open Network (TON) blockchain.

Though the TON Blockchain’s Initial Coin Offering (ICO) garnered around $1.7 billion, the US Securities and Exchange Commission (SEC) blocked its debut in 2019 owing to an alleged unregistered securities transaction. Telegram ended its connection with TON in 2020, citing governmental difficulties and legal conflicts, while Pavel Durov confirmed the project’s complete demise.

However, after 2020, the community and independent developers continued to create TON Blockchain without Telegram’s assistance. Despite the split between creator and creation, Telegram continued to incorporate blockchain components such as crypto payment tools and wallet/exchange connectivity through bots. A small group of open-source developers then took up the project, resulting in the foundation of the TON Foundation in May 2021.

Durov’s aim for the original TON project and his position on user privacy may be described by the following comment from 2018:

“Privacy is not for sale, and human rights should not be compromised out of fear or greed.” A future in which TON Blockchain connects with Telegram would provide several benefits that might change how users engage with cryptocurrency and decentralized applications (Dapps). Transactions completed directly on the platform would expedite user payments, allowing for more efficient and direct financial procedures that avoid typical bank bottlenecks.

Furthermore, the introduction of cryptocurrency wallets and/or Dapps on the site would provide users with a direct connection to the TON Blockchain ecosystem, promoting blockchain adoption and use. However, non-technical consumers may confront steep learning curves when first encountering blockchain technology, stifling long-term adoption in the absence of sufficient pedagogical advice.

Telegram’s small decentralized Apps, or small Apps, are already demonstrating DApp interoperability. On March 29, Justin Hyun, the director of investments at the TON Foundation, informed that these Mini Apps might serve as a “Trojan horse” for blockchain adoption.

Telegram’s philosophy of privacy and security, together with the platform’s large user base, creates a suitable environment for the effect of TON Blockchain integration. Telegram is already used for communication by both businesses and individuals, so the combination would be a significant driver for boosting blockchain growth and acceptance.

Pavel Durov, the inventor of Telegram, has dedicated the messaging app’s future to blockchain technology, outlining huge plans to tokenize features, split ad income with users, and integrate Tether’s stablecoin at Token 2049.

Speaking in front of a packed audience in Dubai, Durov praised blockchain’s capacity to promote freedom and privacy before detailing ambitious ambitions to expand functionality on The Open Network (TON).

“The reason we love blockchain. It’s a technology of freedom. We care about freedom. Even our logo, the paper airplane symbolizes freedom to move in three dimensions,” Durov said.

The app’s inventor, who claims it has over 900 million monthly users, stated that the firm aspires to enable users to create tools, apps, and companies using Telegram.

According to Durov, Telegram’s monetization strategy differs from that of other big messaging and social media companies, which sell user data to advertising. Telegram has announced intentions to split income with content creators on its platform via the Ad Network.

Durov called the change “one of the most generous revenue-sharing models in the history of social media.” He also stated that 50% of Telegram’s earnings from displaying advertisements and broadcasting channels will be shared with channel owners and content producers on TON’s network:

“All these transactions, the payments for ads, withdrawals of ads are powered by blockchain. We will use the TON blockchain exclusively for that.”

Durov thinks that the blockchain-based advertising business may be worth tens of billions of dollars, with users ranging from owners of huge group chats to content producers receiving a fair portion of the money.

The implementation of a blockchain technology will also allow Telegram to circumvent the payment processing limitations imposed by Apple and Google on in-app purchases.

Despite this, Telegram has enabled app developers and merchants to sell tangible items and services through the integration of 40 payment partners, including Stripe.

Durov also stated that Telegram has already experimented with tokenization, becoming the first social media network to tokenize its user namespace. According to the creator, this in-platform market earned $350 million in sales, and he stated that tokenizing additional aspects of its platform is in the works.

“The next step that we are going to undertake is tokenizing Telegram stickers.”

Durov stated that Telegram need the scalability provided by TON’s network, which is capable of processing tens to hundreds of millions of transactions in the future.

Durov stated that we enjoy blockchain technology because we value freedom and expect that there will be fewer crypto scam initiatives, allowing people to freely construct their own tools, services, and enterprises. Telegram will provide third-party developers greater latitude than other communication apps, and additional apps and chat rooms will be pushed later this year.

Durov stated that in the next weeks, an introduction for artists would be released, creators will get 70% of their money, and in-app sales of real and digital items will be permitted. Similarly, Telegram channel owners will be allowed to withdraw 50% of their advertising money for the first time.

Tether, a stablecoin operator, established relations with Telegram’s Web3 ecosystem and released the USDT stablecoin on The Open Network (TON), which is tied to the US dollar. The increased permitted issue of USDT on the TON blockchain reflects the stablecoin’s rising acceptability and use across several blockchain platforms. Tether, a stablecoin, is tied to the US dollar and used to ease transactions between other cryptocurrencies. The statement was made during a joint keynote address at the Dubai crypto event Token2049 by Tether CEO Paolo Ardoino, Telegram founder Pavel Durov, and The Open Platform CEO Andrew Rogozov.

In June 2024, the permitted supply of USDT on the TON blockchain rose to over $580 million. This places TON as the sixth-largest blockchain for USDT issuance, after Tron, Ethereum, Solana, Avalanche, and Omni.

TON Wallet has joined with the TON Foundation to give $30 million in TON tokens to USDT holders. Participants can also earn 50% annually on their holdings. TON Wallet users may now send USDT to contacts for free or withdraw to other TON wallets till the end of June.

Tether also announced on April 19, 24 that it will launch the gold-pegged Tether Gold (XAUT) stablecoin on TON.

According to Ardoino, TON and Tether envision an open, decentralized internet and a borderless financial system.

“The launch of USDT and XAUT on TON will allow seamless value transfer, increasing activity and liquidity while offering users a financial experience that can match those found in the traditional financial system,” the Tether CEO stated.

This recent breakthrough is another step in Tether’s spread across several blockchains, expanding its coverage to 15 chains, including Tron and Ethereum. The milestone is especially significant for the TON network, whose native cryptocurrency, Toncoin (TON), has surpassed Dogecoin as the ninth-largest cryptocurrency by market cap on April 16.

USDT’s debut on TON is unusual in that the TON ecosystem allows transfers between fiat and crypto and aims to outperform traditional finance in efficiency and ease of use. TON Foundation’s marketing director, Jack Booth,

“[There are] built-in on-ramps for fiat at the launch and global off-ramps to bank cards and accounts coming soon. This will be the first time a mass audience will be able to use crypto infrastructure for global payments.”

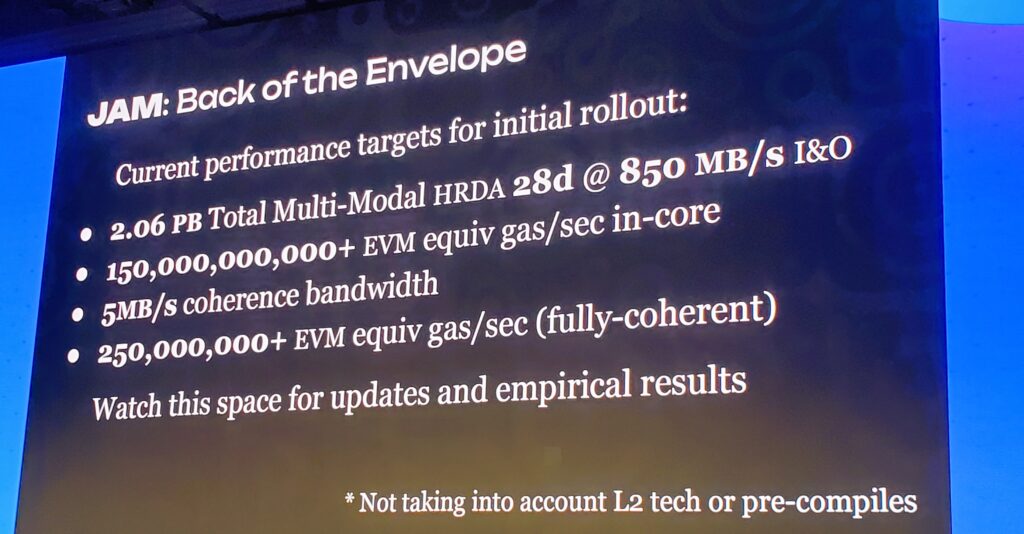

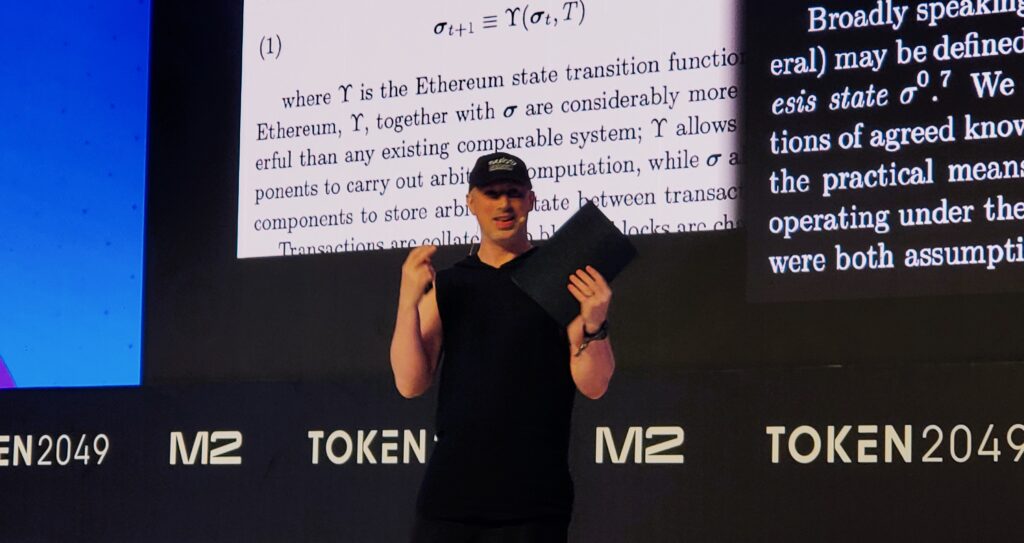

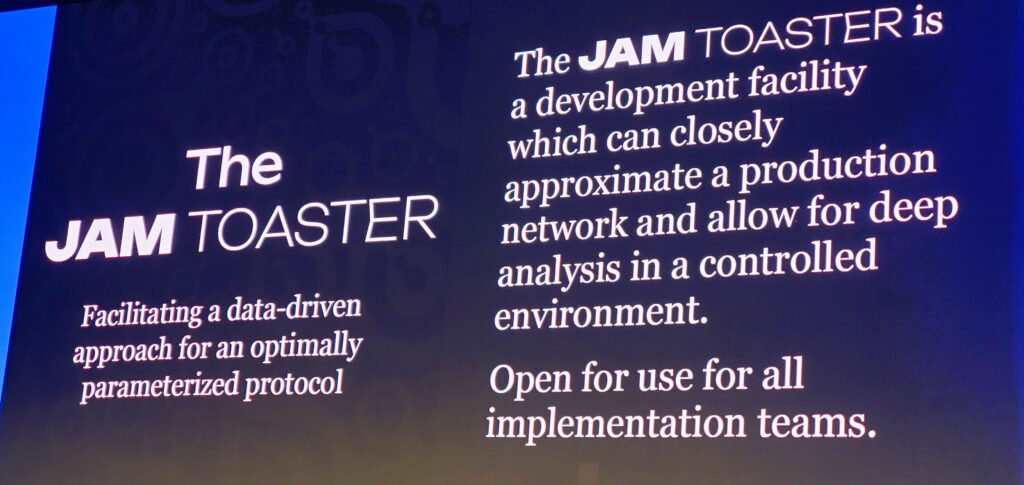

Polkadot co-founder Gavin Wood presented a graypaper explaining the Join-Accumulate Machine (JAM) at the Token2049 conference in Dubai this week, calling it “a proposal for the future of Polkadot.”

In a “major revision,” the JAM protocol would replace Polkadot’s Relay Chain with a “more modular, minimalistic design,” resulting in a permissionless object ecosystem similar to Ethereum’s smart contracts.

“JAM will allow Polkadot to run generic “services”, smart contract logic which can process the result of execution on cores,” Polkadot founding organization the Web3 Foundation’s statement.

JAM will include a parachains service that can operate current parachains created on the Substrate blockchain framework, allowing developers to continue using Substrate to create and deploy their own blockchains. Other technological enhancements include the replacement of WebAssembly with the Polkadot Virtual Machine.

Alongside the announcement of the graypaper, the Web3 Foundation announced the JAM Implementer’s Prize, a $10 million DOT prize pool, “aimed at fostering diversity in the development of the JAM protocol.” The prize aims to “encourage the creation of multiple client implementations,” in a bid to enhance the network’s resilience, the Web3 Foundation added.

Decentralized, community-driven financing protocol Polimec has revealed the first wave of projects scheduled to collect financing through the platform.

Polkadot development platform Apillon, which allows developers to construct NFTs and other Web3 projects using API connections and a drag-and-drop UI, is one of the first projects to raise financing on Polimec.

Mandala Chain, another project, attempts to create an ecosystem for dapps by building an EVM-compatible, open, permissionless public blockchain atop Substrate. And gotEM is an investigative DAO that allows users to crowdfund and crowdsource resources for investigations and private security activities through a secure, decentralized architecture.

The Polkadot-based Polimec allows projects to solicit cash using on-chain credentials while being regulatory compliant.

“JAM is permissionless in nature, allowing anyone to deploy code as a service on it for a fee commensurate with the resources this code utilizes and to induce execution of this code through the procurement and allocation of core-time, a metric of resilient and ubiquitous computation, somewhat similar to the purchasing of gas in Ethereum. We already envision a Polkadot-compatible CoreChains service.”

At the center of this idea is JAM, a new version of the Polkadot chain that will extend Polkadot’s capabilities beyond the existing Web3 restrictions while allowing a wide range of technologies to be deployed on Polkadot. With JAM, revolutionary scalability, previously only seen in rollups, is extended to the consensus layer.

When completely developed, JAM will be a distributed computer capable of executing practically any job that can be represented as a service. JAM drives Polkadot toward synchronous composability, which reduces fragmentation and consolidates activity, allowing Polkadot apps to better use the ecosystem’s network activities. This will open up a new vista of possibilities for deep innovation, providing developers with a strong environment in which to innovate like never before.

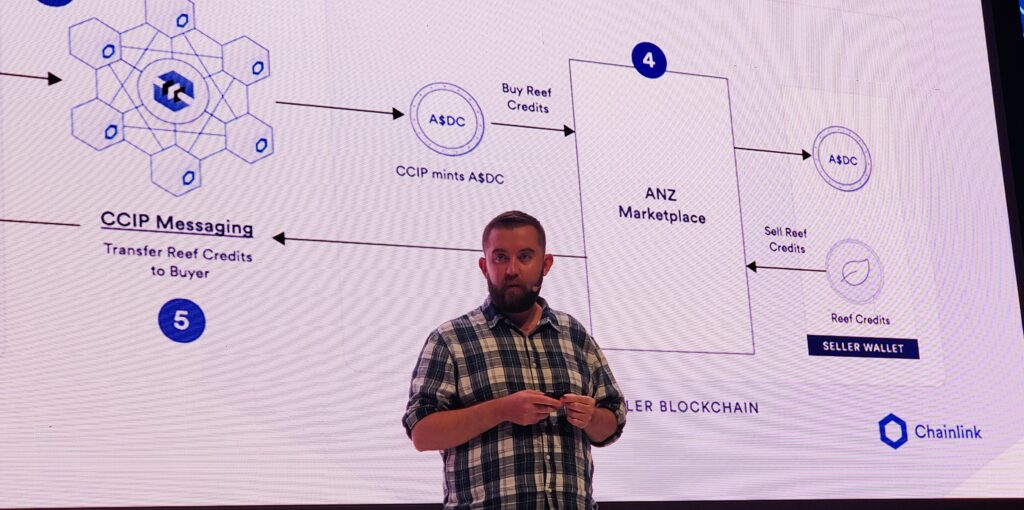

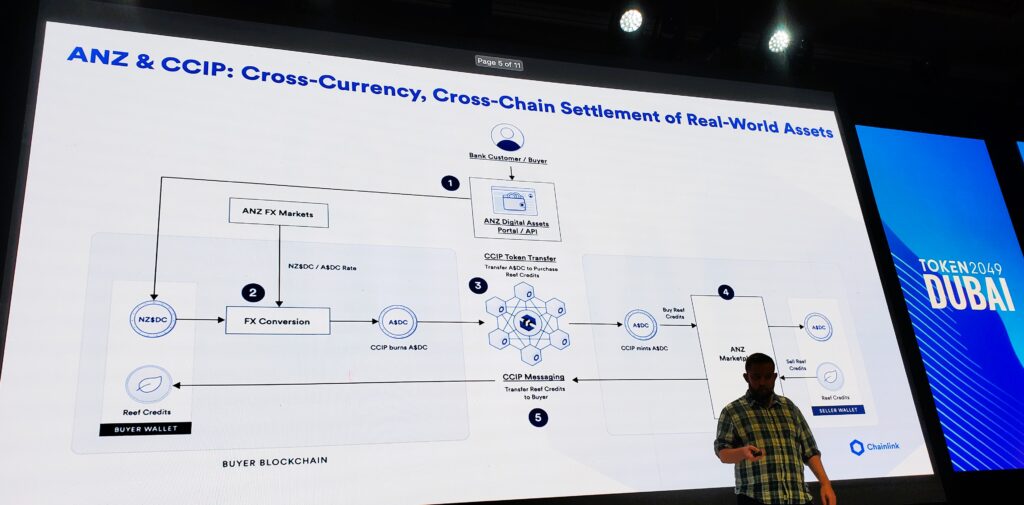

Sergey Nazarov cofounder of Chainlink, his keynote speech discussing the next generation of DeFi and how to connect Web3 to capital markets, was ind boggling.

Chainlink, the industry-standard decentralized computing platform, has facilitated over $12 trillion in transaction value and offers a full suite of services essential for producing and safeguarding tokenized assets throughout the multi-chain economy.

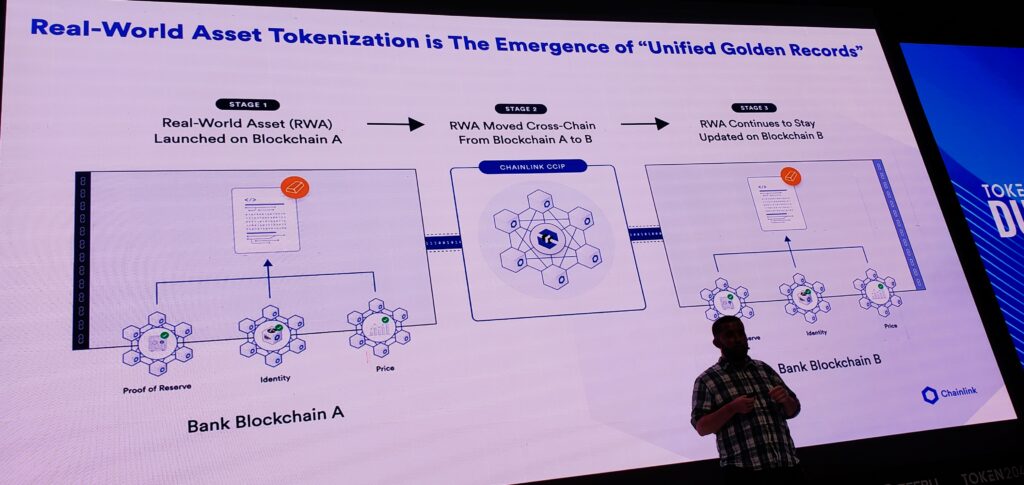

Beyond allowing atomic settlement and more effective collateral management, Chainlink-powered tokenized assets may function as a unified golden record, combining ownership rights and critical data about the underlying asset into a single constantly updated smart contract.

“If something changes about the asset, the onchain record reflects that,” Nazarov said. He explained how the ability for anyone to understand the status of an asset in real time benefits both individuals and the entire financial system.

“If you look at the systemic financial system failures, what they basically boil down to is information asymmetries, where one group like the asset issuer was very educated about the asset. They knew that the underlying mortgages were not good, so they didn’t buy them, but they sold them.”

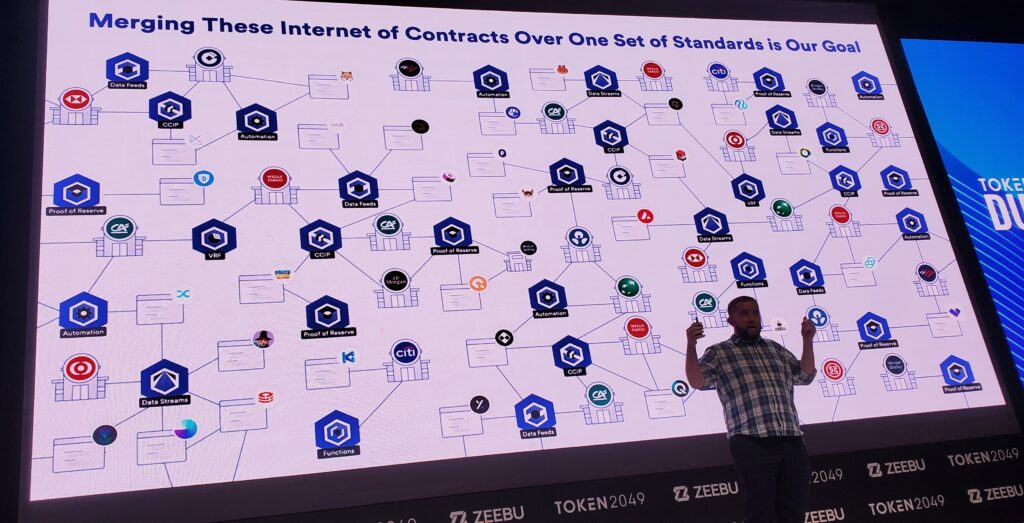

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) opens up new markets and use cases for tokenized assets by allowing them to freely flow between private bank chains and public DeFi applications, eventually providing a single standard for traditional finance and web3 to merge into a global internet of contracts.

Nazarov emphasized why CCIP is a critical building element for tokenized assets in a world where various banks and asset managers would undoubtedly develop their own chains. Without a single blockchain interoperability standard, liquidity fragmentation would prevent such assets from succeeding.

Nazarov stresses the importance of interoperability between different blockchains. He believes that this is essential for DeFi to scale and become mainstream. Chainlink is working on developing protocols that will allow different blockchains to communicate and interact with each other.

“Even if you make a successful real-world asset or token on one of those bank chains and you’re not connected to all the chains that have the liquidity, you’re not going to get the purchasing power; you’re not going to get the success that you’re looking for,” he said.

“That is really where all this is going – it’s going to a single global internet of contracts where all of the public chains and all of the private chains are interconnected with each other, and if a high-quality asset appears on any one of them, they can all interact with it in a compliant, high-speed, secure way.”

Nazarov paints a picture of a future where DeFi is integrated into the mainstream financial system. He believes that this will lead to a more efficient, transparent, and inclusive financial system. Chainlink is playing a key role in making this vision a reality.

Sergey Nazarov, the visionary CEO of Chainlink, recently outlined a compelling roadmap for the future of decentralized finance (DeFi) and its integration with traditional capital markets.

At the heart of Nazarov’s vision lies the critical role of data. He says that for DeFi to truly revolutionize the financial landscape, it must seamlessly incorporate real-world data. This data will serve as the bedrock for innovative financial products, robust risk management strategies, and unprecedented transparency within the ecosystem. This data can be used to create new financial products, improve risk management, and increase transparency.

Chainlink, according to Nazarov, is poised to be the linchpin connecting the worlds of Web3 and traditional finance. By providing secure and reliable data feeds, the platform aims to facilitate the seamless flow of information between these two realms. This convergence, Nazarov believes, will not only attract traditional financial institutions to the DeFi space but also unlock a myriad of opportunities for DeFi projects.

Interoperability, Nazarov emphasized, is another cornerstone for the future of DeFi. He stressed the need for different blockchains to communicate and collaborate effectively. Chainlink is actively developing protocols to foster this interconnectivity, which is crucial for the scaling and mainstream adoption of DeFi.

Nazarov’s keynote painted a picture of a future where DeFi is deeply embedded in the fabric of the global financial system. This future, he envisions, will be characterized by efficiency, transparency, and inclusivity. Chainlink, with its focus on data, security, and interoperability, is positioning itself as a key player in bringing this vision to fruition. Nazarov outlines Chainlink’s strategy for connecting Web3 to capital markets. He believes that by providing secure and reliable data feeds, Chainlink can help to bridge the gap between the two worlds. This will allow traditional financial institutions to participate in the DeFi ecosystem and will also open up new opportunities for DeFi projects.

As the financial industry continues to evolve, Nazarov’s insights offer a valuable perspective on the potential of DeFi and the role of technology in shaping its future.

Balaji Srinivasen highlighted as an era where technology is reshaping every aspect of our lives, a bold new concept is emerging at the intersection of health, technology, and community: The Don’t Die Network State. This innovative approach to health and longevity is catching the attention of forward-thinking entrepreneurs, investors, and health enthusiasts alike.

The Concept:

The Don’t Die Network State is a global, decentralized community focused on extending human health and lifespan. It aims to create a comprehensive ecosystem that leverages cutting-edge technology to empower individuals in their pursuit of optimal health and longevity.

Key Features:

1. Global Health Platform: A blockchain-based system providing access to advanced health tests, innovative therapies, and expert medical advice.

2. Cryptocurrency Integration: Facilitating seamless, borderless transactions for health services and research funding.

3. Data-Driven Health Optimization: Utilizing AI and big data analytics to provide personalized health strategies.

4. Community Collaboration: Fostering a network of health-conscious individuals sharing knowledge and resources.

Market Potential:

The global anti-aging market is projected to reach $421.4 billion by 2030, according to Allied Market Research. The Don’t Die Network State is positioned to capture a significant portion of this growing market by offering a unique, technology-driven approach to longevity.

Challenges and Opportunities:

While the concept faces regulatory hurdles and requires significant technological development, it presents enormous opportunities for entrepreneurs and investors. Early movers in this space could potentially reshape the healthcare industry and tap into a market of health-conscious consumers willing to invest in cutting-edge longevity solutions.

Expert Opinion:

Dr. Sarah Chen, a biotech entrepreneur and longevity researcher, states, “The Don’t Die Network State concept represents a paradigm shift in how we approach health and aging. By combining advanced technology with community-driven initiatives, we could see unprecedented advancements in human longevity.”

Investment Landscape:

Venture capital firms are increasingly interested in longevity-focused startups. In 2023, over $4 billion was invested in age-tech and longevity companies, according to AgingAnalytics.com. The Don’t Die Network State concept is attracting attention from both traditional VCs and crypto-focused investment funds.

Future Outlook:

As the concept evolves, we can expect to see the emergence of startups focusing on various aspects of the Don’t Die Network State ecosystem. From blockchain-based health data management to AI-driven longevity protocols, the potential for innovation is vast.

Conclusion:

The Don’t Die Network State represents a bold vision for the future of health and longevity. While still in its conceptual stages, it highlights the growing intersection of health, technology, and community-driven initiatives. For businesses and investors looking to position themselves at the forefront of health innovation, this emerging field offers exciting opportunities to shape the future of human health and longevity.

The Digital Chamber Founder & CEO, Perianne Boring, moderated Navigating The Legal Landscape: Perspectives on Global Crypto Regulation panel at Token 2049 Dubai with industry leaders Richard Teng and Matthew Roszak.

The rapid growth and increasing mainstream adoption of cryptocurrencies and digital assets have caught the attention of regulators worldwide. For businesses looking to enter or expand in this space, understanding the shifting regulatory environment is crucial. This article provides key insights into the evolving global regulatory landscape for cryptocurrencies and offers guidance for businesses navigating this complex terrain.

The Regulatory Landscape

Governments and regulators across the globe are taking diverse approaches to crypto regulation. Some jurisdictions are embracing comprehensive frameworks, while others are addressing specific aspects or taking a wait-and-see approach. Key regulatory issues being addressed include:

Investor protection: Ensuring safeguards against fraud and market manipulation.

Anti-money laundering (AML) and Know Your Customer (KYC) requirements: Preventing illicit activities and enhancing transparency.

Custody and storage of digital assets: Establishing standards for secure asset management.

Classification and treatment of different crypto assets: Determining how various digital assets should be categorized and regulated (e.g., as currencies, securities, or commodities).

Regional Spotlights

The European Union is taking a lead with its comprehensive Markets in Crypto-Assets (MiCA) framework, which aims to provide a unified approach across member states. The United Arab Emirates has positioned itself as a crypto-friendly hub, actively developing regulations to attract blockchain businesses. In contrast, China has taken a restrictive stance, effectively banning most crypto-related activities.

These examples highlight the varying levels of regulatory maturity across different markets. While some jurisdictions are racing ahead, others are still in the early stages of developing their approach to crypto regulation.

Key Considerations for Businesses

For businesses operating in the crypto space, staying ahead of regulatory developments is critical. Here are some key considerations:

Monitor the regulatory landscape closely: Dedicate resources to tracking regulatory changes in relevant jurisdictions.

Adapt business models: Be prepared to adjust operations to comply with new regulations as they emerge.

Navigate multi-jurisdictional challenges: Develop strategies for operating across regions with divergent rules.

Engage with policymakers: Participate in industry associations and regulatory consultations to help shape the future of crypto regulation.

Prioritize compliance: Invest in robust compliance programs to meet evolving regulatory requirements.

Future Outlook

The trend towards increased regulatory clarity and harmonization is likely to continue. Public-private collaboration will play a crucial role in shaping effective regulations that balance innovation with consumer protection. While increased oversight may pose challenges, it also has the potential to enhance legitimacy and foster wider adoption of crypto technologies.

Conclusion

The evolving crypto regulatory landscape presents both significant opportunities and risks for businesses. Those that stay agile, proactive, and engaged with regulatory developments will be best positioned to thrive in this rapidly transforming industry. As the regulatory environment matures, businesses that have built strong foundations of compliance and governance will likely find themselves with a competitive advantage in the crypto economy of tomorrow.

Roger Ver, founder of Bitcoin.com, a prominent figure in the cryptocurrency space, shared his insights on “Crypto and the Pursuit of Freedom”, emphasizing on the current state and future of the industry at the TOKEN2049 conference in Dubai in April 2024.

Key insights from Roger Ver’s talk include:

- The power of blockchain technology: Ver emphasized the transformative potential of blockchain, highlighting its ability to break down traditional barriers and create new opportunities for individuals and businesses worldwide. He stressed the importance of peer-to-peer transactions, reduced regulatory burdens, and increased financial freedom enabled by this technology.

- The need for widespread adoption: While acknowledging the growing momentum and interest in cryptocurrencies, Ver urged for greater adoption to fully realize the benefits of this technology. He encouraged the audience to actively use cryptocurrencies in their daily lives, such as paying bills or sending money to friends, to drive broader acceptance.

- The distinction between cryptocurrency accounts and wallets: Ver clarified the crucial difference between cryptocurrency accounts offered by centralized platforms and self-custodial wallets that provide users with full control over their funds. He advocated for the use of wallets to maximize the advantages of decentralization and security.

- The future of privacy coins: Ver expressed his enthusiasm for privacy-focused cryptocurrencies, highlighting the importance of protecting financial privacy in an increasingly surveilled world. He encouraged further exploration and development of privacy-enhancing technologies within the cryptocurrency ecosystem.

- The potential of artificial intelligence: Ver touched upon the potential impact of artificial intelligence (AI) on various industries and daily life. He emphasized the positive aspects of automation and its ability to free up human time and resources for more creative pursuits.

Overall, Roger Ver’s talk provided valuable insights into the cryptocurrency landscape, emphasizing the technology’s potential to revolutionize the financial system and empower individuals. He encouraged the audience to actively participate in the growth of the industry through education, adoption, and support for privacy-focused initiatives.

In typical degen flair, two friends have assembled the largest organic group of the crypto community for Token2049 Dubai. The Telegram group, eponymously called “Token2049 Dubai with Tobi and Brent,” has swiftly expanded to over 3000 members since its establishment on March 13, 2024.

Tobi and Brent, known for their severe anti-shilling strategy, are taking measures to maintain the group’s communal spirit and mutual benefit. These characteristics appear to have allowed them to retain a diverse portfolio of VCs, LPs, projects, and other crypto natives.

These self-proclaimed ‘bros’ sponsored the largest social side event of Token2049 Dubai. Over 800 individuals attended the event, which took place at Lock, Stock & Barrel in JBR.

Their success thus far demonstrates the community’s desire for a more authentic approach to the cryptocurrency landscape. Aquanow, Bitlayer, bitSmiley, Blockchain Founders Fund, Faculty Group, Kaisar, Magna, Softstack, Unicorn Ultra, ZeroLend, and zkPass are among the notable sponsors for this personal approach event.

“I was traveling a lot for work and I realized a lot of countries were lacking fun but valuable networking opportunities with cool people. They say if you want something done right, do it yourself – so that’s what I did. I’ve created niche crypto communities in Singapore, Hong Kong, Bangkok, Denver, and NYC, and now we’re taking Dubai by storm.” commented Tobias Bauer (Tobi).

Brent Fulfer, the other half of this dynamic duo shared, “The response has been humbling. We knew it would be big but we didn’t imagine it would reach this scale. This group is incredible. After we pull this off, I’m excited to see what’s next.”

Tobi and Brent have a lighthearted approach to serious business, and they are quite active on social media, blending amusing satirical skits about being web3 investors with genuine advise and observations.

Uniminer boasts numerous mining fields and top-tier mining resources worldwide. Among the many POW-based cryptocurrency projects, Uniminer introduces a digital mining model powered by AI algorithms. This model dynamically adjusts mining strategies in real-time based on algorithmic data, aiming to enhance profitability.

Uniminer utilizes big data models to fine-tune the configuration of mining operations, including mining sites and machinery, in order to maximize asset efficiency. For instance, following the Bitcoin halving event in April 2024 and upon confirmation of variables like coin price and mining equipment availability, we will strategically increase investments in Bitcoin mining machinery and adjust the configurations based on real-time conditions.

BingX, a renowned cryptocurrency exchange, served as the headline sponsor at TOKEN2049 Dubai. The exchange highlighted its most recent digital asset advancements, giving participants a unique opportunity to connect with the BingX team.

Vivien Lin, BingX’s Chief Product Officer, led a pivotal panel discussion on the Main Stage titled “Exchange Evolution: Trends and Transformations in Crypto Markets,” which drew on Lin’s extensive industry knowledge and experience to dissect and debate the dynamic shifts that characterize today’s cryptocurrency exchanges. This interaction sparked talks about upcoming trends and possibilities in the bitcoin sector, which enriched the event’s discourse.

Vivien Lin at TOKEN2049 reflected BingX’s commitment to fostering innovation and progress in the rapidly-evolving crypto markets. As Chief Product Officer, Lin brings to the table a wealth of experience and expertise in the field, making her uniquely qualified to offer valuable insights and guide the conversation. Lin’s participation in this event highlights BingX’s unwavering dedication to transparency and accessibility within the crypto space.

Expressing her enthusiasm for the event, Vivien remarked, “TOKEN2049 serves as a vital platform for shaping the future of the crypto landscape. As BingX remains steadfast in championing accessibility and transparency in the industry, and we’re eager to engage in discussions with other industry leaders to drive positive change and innovation in the Web3 space.”