WHEN DIFC & TRESCON CONVOLVE

His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister, Minister of Finance of the UAE, and President of DIFC, inaugurated the second edition of the Dubai FinTech Summit at Madinat Jumeirah, Dubai, under the theme ‘Pioneering FinTech’s Future.’ Organized by the Dubai International Financial Centre (DIFC), the leading global financial center in the Middle East, Africa, and South Asia (MEASA) region, this year’s summit attracted over 8,000 industry leaders from more than 100 countries.

“The summit aligns with the Dubai Economic Agenda D33’s strategic goal of propelling Dubai into the ranks of the top four global financial hubs by 2033”

H.H. Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum

Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance, UAE

The Dubai FinTech Summit showcased why Dubai stands as a global powerhouse for fintech and innovation. The city offers a unique environment for fintech companies to capitalize on new growth opportunities within this rapidly expanding sector.

- “We have created a dynamic ecosystem for the FinTech industry to thrive, in line with the goal of the Dubai Economic Agenda D33 to establish the emirate as one of the top four financial centres worldwide”

H.H. Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum

Deputy Ruler of Dubai, Deputy Prime Minister and Minister of Finance, UAE

“Dubai today has the ideal infrastructure and legislation to become the world’s global FinTech hub. The city provides a unique environment for FinTech companies to leverage new growth opportunities in this rapidly growing sector. We have created a dynamic ecosystem for the FinTech industry to thrive, in line with the goal of the Dubai Economic Agenda D33 to establish the emirate as one of the top four financial centres worldwide.”

– His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai, Deputy Prime Minister, Minister of Finance of the UAE and President of DIFC

His Highness Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum noted that the second edition of the Dubai FinTech Summit highlighted the ongoing transformation of the technology-led financial sector and emphasizes the urgent need to focus on innovation, financial inclusion, and sustainability as integral aspects of modern life. “Through collaboration and partnerships between banks, financial technology companies, and financial services application platforms, Dubai is poised to lead the future of this dynamic sector. By focusing on customer and investor-centric financial and banking services, this will pave the way for significant advancements in the future,” Sheikh Maktoum said.

His Highness added: “The summit will foster rich discussions on the evolving landscape of finance, driven by the transformative forces of artificial intelligence, digital currencies, and innovative technology. Together with industry leaders, we look forward to exploring the positive impact and opportunities inherent in the use of artificial intelligence in financial services, the growing world of digital currencies and blockchain technology. With its progressive policies, innovative regulations and advanced infrastructure, there is no limit to what Dubai can accomplish in the sector.”

The Dubai International Financial Centre (DIFC) and Trescon Global have formed a powerful partnership, working together to drive the growth of Dubai’s fintech ecosystem. DIFC provides the ideal regulatory framework and the vibrant ecosystem for fintech companies to flourish, while Trescon Global’s expertise in hosting high-quality events attracts international fintech players to Dubai. This joint effort not only positions Dubai as a major player in the global fintech landscape but also creates a ripple effect, encouraging further investment and innovation within the city’s fintech sector.

DIFC and Trescon Global work together to foster the growth of Dubai’s fintech ecosystem and solidify its position as a global leader in the industry. DIFC provides a regulatory framework and infrastructure that supports innovation and attracts fintech companies, while Trescon Global organizes events and conferences that bring together industry leaders, investors, and entrepreneurs. By collaborating, DIFC and Trescon Global create a vibrant ecosystem where fintech companies can network, showcase their solutions, and access the resources needed to succeed. Their combined efforts contribute to Dubai’s reputation as a fintech hub and drive the development of innovative financial technologies in the region.

The opening remarks by H.E. ESSA KAZIM – Governor of DIFC,

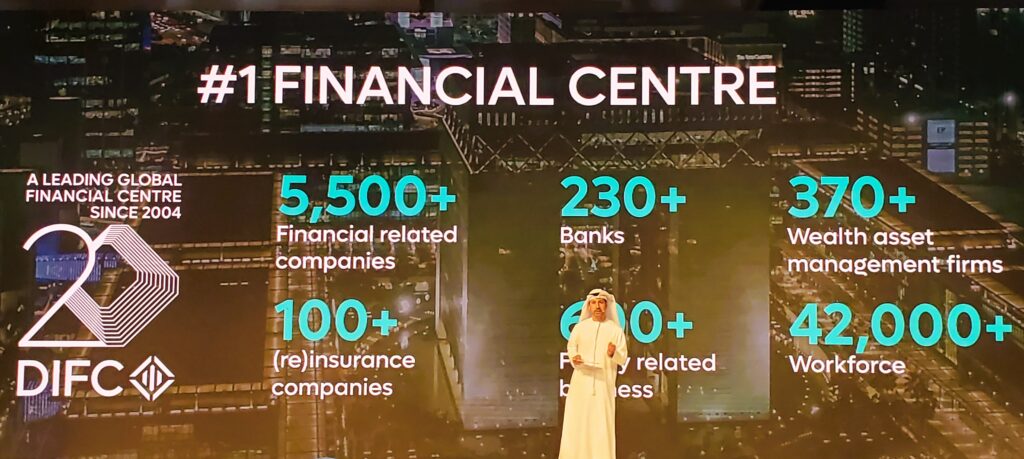

DIFC’s unprecedented growth over the last 20 years has solidified Dubai’s status as the foremost contributor to the global financial services industry within the Middle East, Africa, and South Asia (MEASA) region.

His Excellency Essa Kazim, Governor at DIFC, said: “DIFC has become a major engine of growth for Dubai’s economy and a significant contributor to its GDP. Its accelerated growth trajectory is perfectly aligned with the goals of the Dubai Economic Agenda, D33 to double the size of Dubai’s economy over the next decade and reinforce its status as one of the world’s top three cities for business and investment. DIFC’s unprecedented growth over the last 20 years consolidates Dubai’s status as the MEASA region’s foremost contributor to the global financial services industry.”

He added, “Through strategic initiatives, we seek to provide a dynamic environment for innovation and enterprise to flourish. Dubai and DIFC have invested heavily in its FinTech ecosystem by creating a supportive and agile regulatory framework, and by providing access to funding, sand-box environments and state-of-the-art infrastructure for start-ups and established companies alike. The Dubai FinTech Summit also presents a unique opportunity for collaboration between traditional financial institutions and FinTech firms, especially with rapid AI advancements driving innovation within the sector.”

Global FinTech Sector Overview

The global FinTech sector is experiencing unprecedented growth, with $100 billion in investment in 2023, a 50% increase from the previous year

There are over 100 FinTech unicorns worldwide with a combined valuation exceeding $500 billion

The convergence of finance and technology is a notable trend, with traditional financial institutions embracing innovations like blockchain, AI, and big data analytics

The global digital payments market is projected to reach $10 trillion in transaction value by 2025, driven by the proliferation of mobile wallets, contactless payments, and digital currencies

Dubai as a Global FinTech Hub

Dubai has rapidly emerged as a global FinTech hub, with $2.3 billion in FinTech funding in 2023

Dubai’s strategic location offers FinTech firms access to a market of over 3 billion people with a combined GDP exceeding $12 trillion

The Dubai International Financial Centre (DIFC) has welcomed over 1,000 FinTech and Innovation firms, which have raised over $3.3 billion in VC funding globally

The true value of the Summit lay in its impact, serving as a launchpad for significant announcements and collaborations that are set to reshape the financial industry. “The Dubai Fintech Summit is not just a gathering, it is a platform for transformative discussions and collective action,” emphaiszed H.E. Essa Kazim, Governor of DIFC.

Attracting over 8,000 participants from 118 countries, the Summit emerged as a vibrant hub for ideas, perspectives, and collaborations among various stakeholders in the global fintech industry. During the two-day event, more than 125 discussions were held, exploring diverse topics in fintech innovation, including regulatory frameworks, investment trends, sustainable finance, and the future of banking.

The success of the Summit was rooted in its ability to foster valuable connections and generate actionable insights. From the outset, participants were encouraged to engage in open discussions, challenge conventional ideas, and collaborate on addressing the most pressing challenges facing the financial industry. Furthermore, the Summit served as a significant testament to the ambitions outlined in the Dubai Economic Agenda D33, which aims to establish the Emirate as a leading global fintech hub by 2033.

The second edition of the Dubai FinTech Summit was supported by over 150 global corporate partners. Visa served as the founding partner and co-host, while Emirates NBD acted as the founding partner and premium banking sponsor. e& was the founding partner and ‘powered by’ sponsor, and Commercial Bank of Dubai participated as the founding partner and strategic banking sponsor.

During his opening remarks at the event, Arif Amiri, CEO of DIFC Authority, highlighted that fintech is poised to secure an additional 5% of global financial service revenues this year. He also projected that by 2030, fintech could drive more than 25% of banking valuations. “Fintech isn’t just reshaping individual financial habits; it is revolutionizing traditional financial institutions,” Amiri added. “Remarkably, global fintech revenues have surged six-fold in recent years. Cryptocurrencies, once niche, have gained mainstream acceptance, propelling their market capitalization past an astonishing US$3 trillion.”

Commenting on DIFC’s role in spearheading this event, Mohammad Alblooshi, CEO of DIFC Innovation Hub, emphasized the Centre’s commitment to fostering innovation and collaboration within the fintech ecosystem. He highlighted that the DIFC is not only a platform for financial services but also a catalyst for technological advancement, positioning Dubai as a leading global hub for fintech. Alblooshi noted the importance of creating an environment that supports startups and encourages partnerships, which is essential for driving growth in the sector. His leadership in organizing events like the Dubai FinTech Summit reflects DIFC’s strategic vision to enhance its reputation and influence in the global fintech landscape. “As the leading global financial center in the MEASA region, DIFC provides a unique platform for the Summit where regional voices are heard, local innovations are showcased, and unique challenges are addressed. We leverage our extensive network and expertise to connect fintech players with regional opportunities and resources. This strengthens Dubai’s role as a gateway, enabling cross-border collaboration and driving fintech innovation across the region and beyond.”

“Nearly 60 per cent of all FinTech companies in the GCC are currently based in Dubai. With the industry growing at an unprecedented rate, it is crucial for stakeholders to gather and discuss the challenges and opportunities that lie ahead. The Dubai FinTech Summit will bring together the most prominent figures in the industry, with an agenda that is aimed at driving innovation, inclusivity, and growth for all.”

“The demand for fintech services has grown significantly in the last few years, powered by digital technologies and innovation across sectors,” he explains. “We have an optimistic outlook about the growth of the fintech landscape. It is grounded in the UAE’s continuous efforts to facilitate an innovation-driven economy, supported by state-of-the-art infrastructure, a forward-thinking regulatory environment, and a vibrant ecosystem that encourages entrepreneurial ventures. Increasing adoption of digital payments, the emergence of blockchain technologies, and the growing interest in sustainable and inclusive financial services is driving the next wave of financial solutions.”

“We envision Dubai as a global leader in fintech,” he declares. “Our aim is to continually support innovation, attract top talent and investment, and maintain a cutting-edge regulatory framework. We look forward to delivering an exceptional event that will inspire and empower the fintech community.”

H.E. Abdullah Bin Touq Al Marri, Minister of Economy of the UAE, shared his insights on the fintech industry and the government’s efforts to develop and enable this sector in the UAE. He highlighted the following key points:The UAE government has taken significant steps to create a conducive environment for fintech innovation, including:

- Allowing 100% foreign ownership of companies in Mainland

- De-criminalizing bounced checks* Introducing new regulations to combat illicit financial activities.

- These changes have led to a surge in fintech activity in the UAE, with over 275,000 new business licenses issued in 2021-2022. The UAE is now home to over 800 fintech companies, and the government is aiming to reach 1 million by 2025.The UAE government is also investing heavily in fintech infrastructure, such as the Dubai International Financial Centre (DIFC) and the Fintech Hive. These initiatives are helping to attract fintech talent and investment to the UAE.

The UAE government is also investing heavily in fintech infrastructure, such as the Dubai International Financial Centre (DIFC) and the Fintech Hive. These initiatives are helping to attract fintech talent and investment to the UAE.The UAE government is committed to supporting the growth of the fintech industry. This is because fintech is seen as a key driver of economic diversification and growth. The UAE government is also aware of the potential of fintech to improve financial inclusion and access to credit for underserved populations.Some of the challenges facing the fintech industry in the UAE include:

Competition from other countries in the region

The need to comply with complex regulations

The risk of cybercrime

The UAE government is working to address these challenges. For example, the government is working to streamline the regulatory environment for fintech companies. The government is also investing in cybersecurity infrastructure.H.E. Abdullah Bin Touq Al Marri believes that the fintech industry in the UAE has a bright future. He is confident that the UAE government’s policies will continue to support the growth of this sector.In addition to the above, H.E. Abdullah Bin Touq Al Marri also shared his insights on the following topics:

The impact of the COVID-19 pandemic on the fintech industry* The role of fintech in promoting financial inclusion* The challenges and opportunities of artificial intelligence in fintech* The importance of international cooperation in fintech. Overall, H.E. Abdullah Bin Touq Al Marri’s insights provide a valuable overview of the fintech industry in the UAE. His comments are also relevant to fintech professionals and investors around the world.

The key observations from the chat with H.E. Abdullah Bin Touq Al Marri -The UAE government has taken significant steps to create a conducive environment for fintech innovation, including:

Allowing100% foreign ownership of companies in Mainland.

De-criminalizing bounced checks. Introducing new regulations to combat illicit financial activities.

These changes have led to a surge in fintech activity in the UAE, with over 275,000 new business licenses issued in 2021-2022. The UAE is now home to over 800 fintech companies, and the government is aiming to reach 1 million by 2025.The UAE government is also investing heavily in fintech infrastructure, such as the Dubai International Financial Centre (DIFC) and the Fintech Hive. These initiatives are helping to attract fintech talent and investment to the UAE.The UAE government is committed to supporting the growth of the fintech industry. This is because fintech is seen as a key driver of economic diversification and growth.

The chat with Hamed Ali, Chief Executive Officer, Dubai Financial Market at the Dubai FinTech Summit 2024, discussed the exchange’s recent growth and future prospects. He highlighted the DFM’s efforts to attract new investors and listings, including both government and private sector companies, especially family businesses. He also emphasized the importance of diversifying the investor base, attracting more international investors and building strong collaborations with regional exchanges. The speaker outlined the DFM’s commitment to facilitating capital raising and fostering a vibrant market for both established and emerging companies. The discussion revolved around the DFM’s strategies for achieving sustained growth and strengthening its position as a leading financial center in the region.

Here are ways the Dubai Financial Market (DFM) has adapted its regulatory framework to attract family businesses to IPO, according to your sources:

1. Reduced the minimum stake required for listing:** Previously, companies were required to list a majority (55%) of their business, which was later reduced to 35%. The DFM removed this requirement because it presented an obstacle for family businesses hesitant to relinquish control.

2. Shifted focus from percentage to absolute value:** The DFM now prioritizes the absolute value of the listed stake, recognizing that 35% of a large company’s value differs significantly from 35% of a smaller one. This change helps family businesses retain more control while still raising significant capital.

3. Created a more familiar listing template:** By encouraging successful private sector and family business IPOs, the DFM created a template for other family businesses to follow, making the process less daunting and more appealing.

4. Established the Arena platform:** This private market platform caters to growth companies in Series A and C funding stages, providing them with access to capital from DFM investors. By participating in Arena, family businesses can gradually acclimate to the public market environment and potentially transition to an IPO later.

Yie-Hsin Hung – President and CEO of State Street Global Advisors, praised Dubai for its impressive transformation into a significant financial and business center in the region. She noted that the opening of State Street Global Advisors’ office in Dubai demonstrates the company’s dedication to increasing its footprint in this rapidly expanding area and seeking additional opportunities in emerging and nearby markets.

State Street, managing over $4.3 trillion in assets, is expanding its reach in the GCC region. Amidst a surge in affluent clientele, the company seeks to broaden its investor base and increase the funds it manages to $100 billion. Economic diversification initiatives in the GCC are fueling this growth, offering exciting opportunities for State Street.

“What we see here is just incredible wealth accumulation, with financial intermediary market growing, family offices growing, and the talent is abundant here, particularly on the asset management side, which is one reason why we’ve been drawn back to being here in Dubai,” Ms Hung said. “It’s a combination of the market opportunity, as well as the talent and we’re increasing the number of people here, bringing specialist to augment our client coverage.”

The Dubai FinTech Summit 2024, Nic Dreckmann, the Chief Executive Officer of Bank Julius Baer & Co Ltd, participated in a discussion about the “future of wealth management and private banking”. Moderated by Dan Murphyn from CNBC, the session highlighted several critical themes shaping the industry.Julius Baer has incorporated cryptocurrencies into its service offerings, allowing clients to engage in cryptocurrency trading. However, according to Dreckmann, crypto assets make up only a small portion of their clients’ overall portfolios. He noted that while cryptocurrencies are available through the bank, they haven’t significantly boosted revenue, particularly given the recent downturn in the crypto market.

Dreckmann views cryptocurrencies as just the initial phase of a broader movement towards asset digitization, suggesting that the bank sees potential for further developments in this area beyond just cryptocurrencies. He stated, “To digitize other assets will be much more interesting for us at Julius Baer. That’s what we want to advise on, once these markets start to emerge, once we can start selling a fraction and there is liquidity on an ongoing basis.”Julius Baer showcases its innovative approach through its involvement with the Dubai International Financial Centre (DIFC) and its advanced financial offerings. Expressing enthusiasm for the region, Dreckmann remarked, “We are in a very exciting and diverse space, with the DIFC around innovation. And I’m looking forward to continuing this.”

At the Dubai FinTech Summit 2024, Nik Storonsky, the Founder and CEO of Revolut, announced significant **expansion plans in the MEASA (Middle East, Africa, South Asia) region**. This move is part of Revolut’s strategy to enhance financial inclusion through innovative technology solutions in a rapidly growing market.

Revolut’s Rapid Growth and Expansion. Revolut has experienced tremendous growth, expanding from 1.5 million users to over 40 million in just a few years. They are adding about a million new users per month and operate in over 150 countries. The app is the most downloaded finance app in 17 countries. Revolut has achieved 64% growth in daily active users in 2023 and recently surpassed 10,000 employees. The company generated $2 billion in revenue and $350 million in net income in 2023.

Revolut’s Mission and Goals: Revolut aims to provide the best financial products at the best prices, saving customers time and money. They strive to build a truly global bank, offering a unified platform across all countries. Revolut focuses on providing a seamless and user-friendly experience, making it easy for customers to access various financial services.

Challenges and Opportunities in Financial Inclusion: Revolut faces challenges in expanding to different countries due to varying regulations and compliance requirements. They overcome these challenges by building a unified software platform and focusing on local partnerships and compliance. Revolut’s approach of offering a comprehensive range of products and a user-friendly experience is key to their success in financial inclusion.

The Importance of Technology and Innovation: Revolut leverages technology to enhance its products and services, such as using AI for chatbots, translation, and fraud prevention. They continuously invest in research and development to stay ahead of the competition and offer innovative solutions.

Advice for Budding Entrepreneurs: Nik Storonsky advises entrepreneurs to build their products in a systematic way, ensuring compliance with regulations. He emphasizes the importance of being local and understanding the specific needs of each market. He also highlights the potential of the Middle East and Asia as regions for growth and expansion.Revolut’s success can be attributed to their focus on customer experience, technological innovation, and a global approach to financial services.